FCPO - Rounding Top

rhboskres

Publish date: Wed, 13 Jan 2021, 06:07 PM

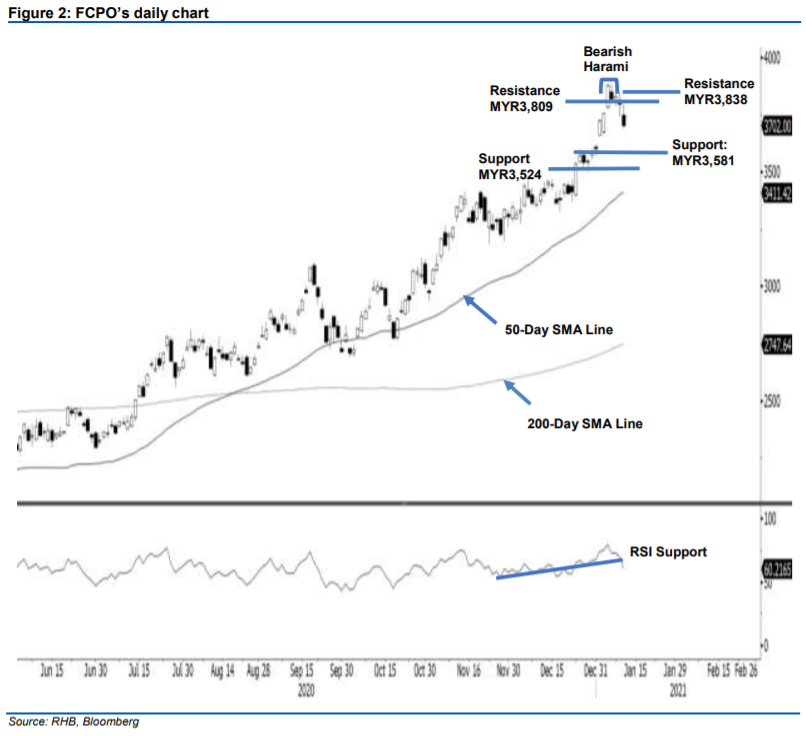

Trailing stop triggered; initiate short positions. The FCPO breached the downside support, falling MYR102.00 to settle at MYR3,695. The commodity gapped MYR47.00 lower to open at MYR3,750. Following a negative opening, the FCPO experienced buying pressure and tested the day high at MYR3,796. However, the brief rebound failed to inspire the commodity to climb higher, as selling pressure emerged during the final trading hours – it was dragged towards the day low at MYR3,690 and last traded at MYR3,702. From the latest price action, the bearish candlestick has confirmed the reversal signal of the Bearish Harami. From here, we shall see the correction phase begin. The RSI indicator has fallen below the trendline, suggesting a bearish momentum ahead. Premised on these factors, we shift to a negative trading bias.

Our previous long positions – which were initiated at MYR3,535, or the closing level of 23 Dec – were closed out during the latest session after triggering a trailing stop at MYR3,763. Conversely, we initiate short positions at the closing level of 12 Jan. To manage risks, a stop loss can be set above the MYR3,838 mark.

The immediate support is marked at MYR3,581 and followed by MYR3,524. On the upside, the immediate resistance is pegged at MYR3,809 – this is followed by a higher resistance: MYR3,838.

Source: RHB Securities Research - 13 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024