WTI Crude - the Bulls Are Marching Ahead

rhboskres

Publish date: Wed, 13 Jan 2021, 06:11 PM

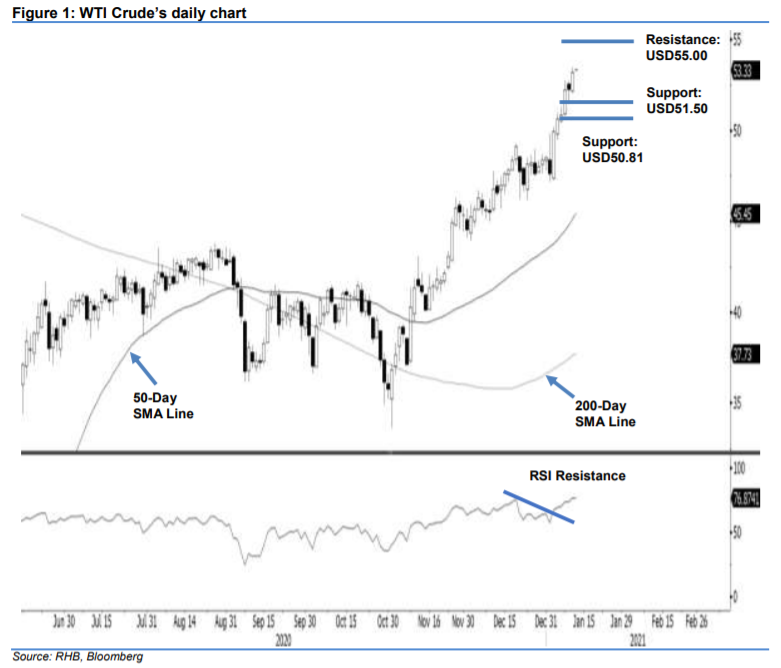

Maintain long positons. The WTI Crude defied our expectation for it to extend its minor consolidation phase, as the commodity continued to scale higher during the latest session. The black gold generally trended higher for the entire session, with the low and high posted at USD52.07 and USD53.45 – it closed USD0.96 stronger at USD52.07. While the price momentum remains strong and is not showing signs of exhaustion, the RSI reading is now flashing out an overbought reading of 76.9. With prices now moving closer towards the USD55.00 resistance point – the next multiple of USD5.00 – price actions around this level are crucial in defining the WTI Crude’s next directional price bias. For now, we are keeping to our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop loss can now be placed at the breakeven level.

Support levels are revised to USD51.50 and USD50.81 – the low of 8 Jan. Conversely, the immediate resistance is maintained at USD54.00 and followed by the USD55.00 threshold.

Source: RHB Securities Research - 13 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024