FCPO - Retracing Lower

rhboskres

Publish date: Thu, 14 Jan 2021, 05:52 PM

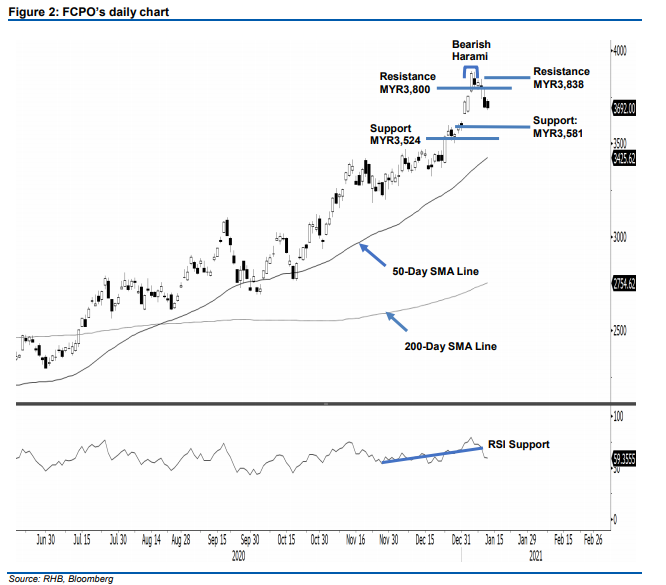

Maintain short positions. The FCPO continued to see weakness in price action, declining MYR3.00 to settle at MYR3,692. The commodity initially had a positive opening, gapping MYR32.00 higher at MYR3,727. It then rose towards the day’s high of MYR3,740. Selling pressure in the afternoon session dragged the commodity towards the day’s low of MYR3,679 before settling at MYR3,692. This price action shows that the commodity has been facing selling pressure since the formation of the Bearish Harami pattern at the top. The RSI is also moving lower suggesting that the commodity is heading towards a correction phase. Meanwhile, on 18 Jan, the near month will switch over to the Apr 2021 futures contract. We think the bulls and bears will adjust their open positions during Thursday’s and Friday’s trading sessions. As such, we expect volatility to taper off. With the commodity facing selling pressure, we switch to a negative trading bias.

We recommend traders to shift to short positions, initiated at MYR3,695, or the closing level of 12 Jan. To manage risks, a stop loss can be set above the MYR3,838 mark.

The immediate support is maintained at MYR3,581 and followed by MYR3,524. On the upside, the immediate resistance is adjusted to the round figure of MYR3,800 – this is followed by a higher resistance of MYR3,838.

Source: RHB Securities Research - 14 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024