WTI Crude - A Minor Pause Below the Resistance Zone

rhboskres

Publish date: Fri, 15 Jan 2021, 05:58 PM

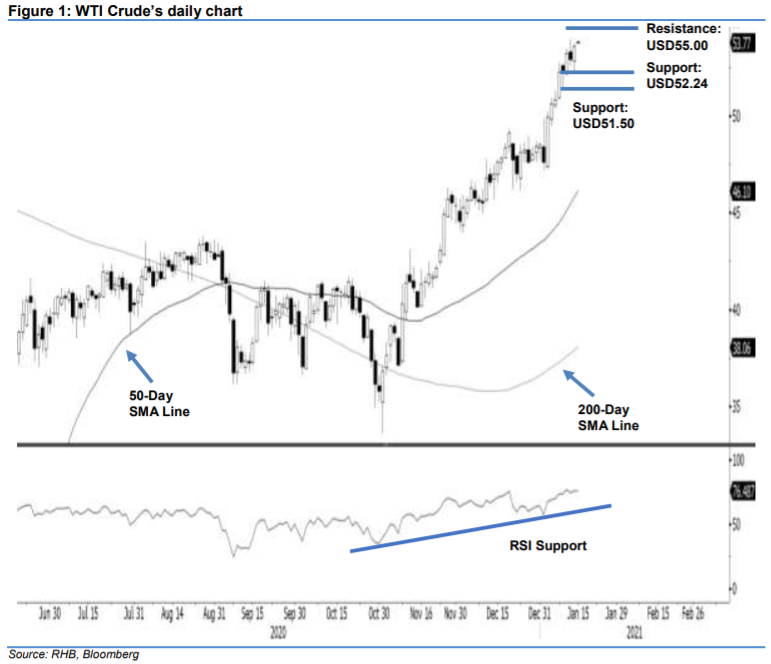

Maintain long positions. The WTI Crude rebounded sharply from an intraday low of USD52.24, registered earlier in the session, handing in a USD0.66 gain to close at USD53.57. The positive intraday price reversal means there was no negative follow-through from the previous session’s decline, which took place below the USD54.00- USD55.00 resistance zone – on the back of an overbought RSI reading. Based on the two recent sessions’ price actions, and the overbought RSI reading, chances are high that the black gold is in the process of developing a minor consolidation phase below this resistance zone. Towards the downside, provided the USD50.00 level does not fail, the risk of a deeper correction phase setting in is still low. Hence, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can be placed at the breakeven level.

Support levels are revised to the latest low of USD52.24 and USD51.50. Conversely, the immediate resistance is maintained at USD54.00, and followed by USD55.00.

Source: RHB Securities Research - 15 Jan 2021