Hang Seng Index Futures - Extending Higher

rhboskres

Publish date: Fri, 15 Jan 2021, 06:03 PM

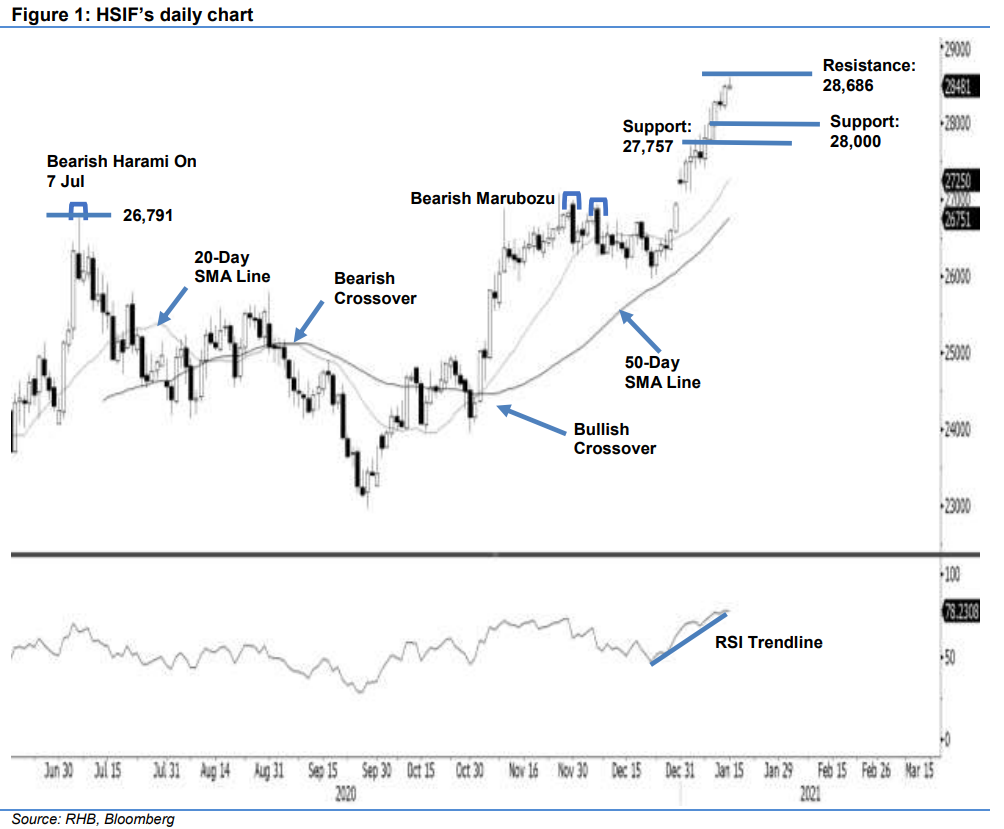

Maintain long positions. The HSIF continues to move higher, on the back of buying interest, rising 240 pts to settle at 28,476 pts. The index opened higher at 28,397 pts. It dipped to the 28,270-pt day low before climbing towards the 28,506-pt day high. In the evening session, bullish sentiment lifted the index towards the session high of 28,607 pts, before it was last traded at 28,481 pts. In the past 10 sessions, the average trading range (ATR) has risen slightly to 210 pts. By using 1x ATR from the latest settlement price of 28,476 pts, we estimate that the next resistance level will be at 28,686 pts. Meanwhile, the support level is marked at 28,000 pts – at least 2x ATR from the latest settlement price. As the RSI is moving above 70% or at overbought territory, we think the index will climb higher to test the resistance level, on the back of strong momentum. As such, we maintain our positive trading bias.

We recommend traders maintain long positions. We initiated these at 26,943 pts, or the closing level of 30 Dec 2020. For risk-management purposes and profit protection, the trailing stop is adjusted to 27,900 pts.

The immediate support is marked at the 28,000-pt round figure, followed by 12 Jan’s low of 27,757 pts. On the upside, the immediate resistance is pegged at 28,686 pts, with the next hurdle at 28,896.

Source: RHB Securities Research - 15 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024