FKLI - Capping By Resistance

rhboskres

Publish date: Fri, 15 Jan 2021, 06:17 PM

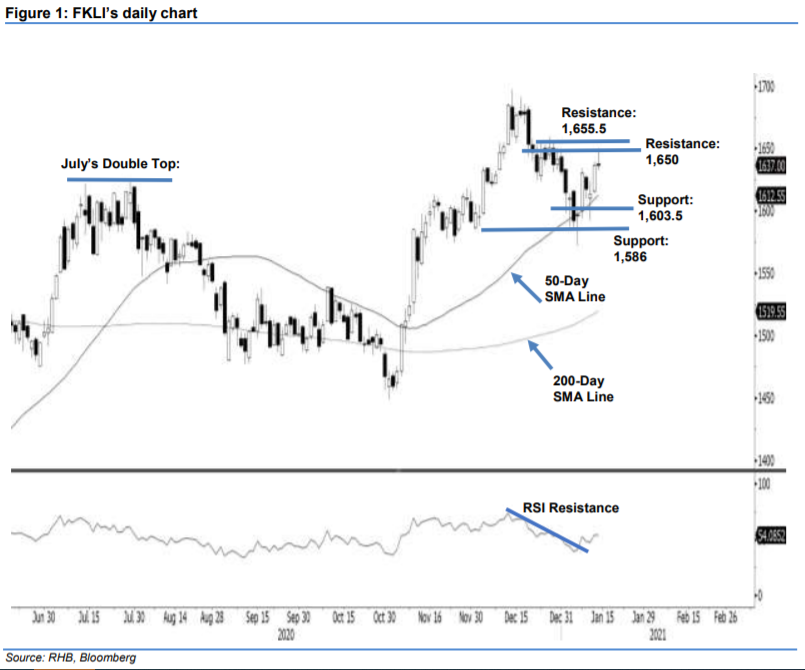

Maintain long positions. Despite being capped by the upside resistance, the FKLI added 0.50 pts to close at 1,637 pts yesterday. Following a rally on Wednesday, the index gapped 1.5 pts higher to open at 1,638 pts. During the first half of the session, the index rose higher to touch the ceiling at 1,649 pts. However, selling pressure emerged in the afternoon, dragged it towards the day’s low of 1,633. The latest session saw a bearish Shooting Star forming near the resistance of 1,650 pts. We think the bulls were merely trimming positions after a strong rally on Wednesday. Nonetheless, the uptrend structure is intact – in previous sessions, the index saw strong buying interest near the 50- day SMA line. As such, it should be a shallow correction ahead. With the RSI trending above the 50% threshold, expect to see the index retest the resistance soon after the correction. As long as the downside stop-loss remains intact, we maintain a positive trading bias.

We recommend that traders maintain long positions. We initiated these at 1,630.5 pts, or the closing level of 8 Jan. To manage downside risks, a stop loss can be set below the immediate support, ie 1,603.5 pts.

The immediate support is kept at 7 Jan’s high of 1,603.5 pts, followed by 6 Jan’s low of 1,586 pts. Towards the upside, the resistance is pegged at 1,650 pts, followed by 29 Dec’s high of 1,655.5 pts.

Source: RHB Securities Research - 15 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024