FCPO - Correction Phase Underway

rhboskres

Publish date: Mon, 18 Jan 2021, 10:19 AM

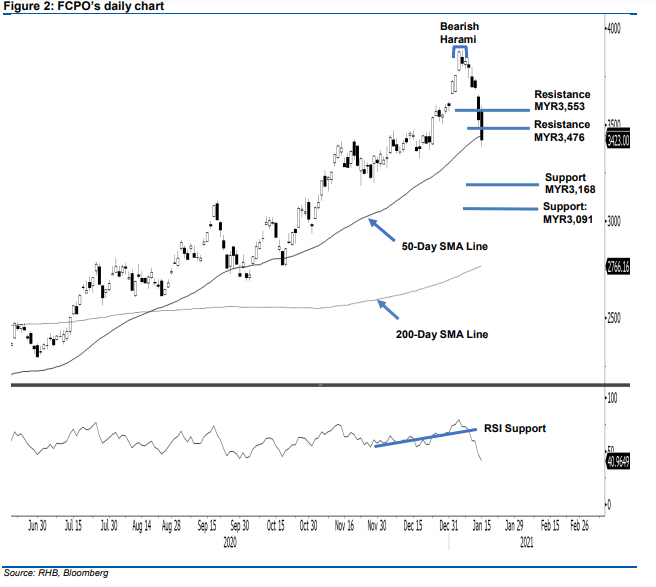

Maintain short positions. The FCPO retracted lower last Friday, plummeting MYR104.00 to see Mar 2021 futures contract settle at MYR3,423. The commodity had a positive opening, gapping MYR53.00 higher to start at MYR3,580. After briefly testing the day’s high of MYR3,600, heavy selling pressure dragged the commodity towards the day’s low of MYR3,388 before finally settling at MYR3,423. Since the formation of the Bearish Harami, the commodity continues to move in a downtrend fashion with lower highs and lower lows. Contrary to our projection previously, the last two sessions saw volatility increase. The average trading range (ATR) of the last 10 sessions further increased to MYR77.00. The coming Monday’s session will see the third-month benchmark CPO futures move to Apr 2021. If we project 2x ATR from the latest settlement price of Apr 2021’s contract of MYR3,322, the lower support is estimated at MYR3,168 while the upside resistance is anticipated at MYR3,476. With the RSI trending below 50, we think the bearish momentum will persist until the resistance level is breached. As such, we maintain a negative trading bias.

We recommend that traders stick to short positions initiated at MYR3,695, or the closing level of 12 Jan. To manage risks, a trailing-loss can be set above the MYR3,515 mark.

The immediate support is revised to MYR3,168, followed by MYR3,091. Towards the upside, the immediate resistance is revised to MYR3,476 – this is followed by a higher resistance of MYR3,553.

Source: RHB Securities Research - 18 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024