E-Mini Dow - A New Uptrend

rhboskres

Publish date: Tue, 19 Jan 2021, 10:14 AM

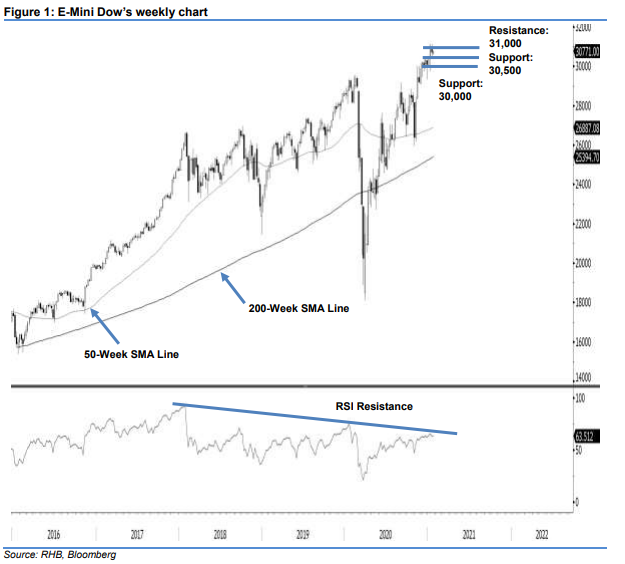

Maintain long positions. We are revisiting the E-Mini Dow’s long-term chart in today’s note. The index experienced its fourth significant correction phase – since the cycle low in year 2009 – in the first quarter of 2020. The phase, which lasted five weeks, saw the index dive by close to 40% – marking one of the sharpest corrections in its history. The recovery from Mar 2020’s low was also one of its steepest, with the index advancing 72% from the low, and now trading near record levels. Following 2020’s correction, we believe the index is now trading in a new long-term uptrend. While its recent weeks’ upward move is among the slowest we have seen throughout the uptrend from Mar 2020’s low, we believe that as long as the 30,000-pt psychological level holds up, the risk of the index experiencing a correction phase in the short-term will be limited. We maintain our positive trading bias.

We recommend traders stay in long positions for now. We initiated these at 30,033 pts, or the closing level of 11 Dec 2020. For risk management purposes, a stop-loss can now be set at the breakeven mark.

We are keeping the support levels at 30,500 pts and the 30,000-pt psychological level. Moving up, the immediate resistance is set at 31,000 pts, followed by 31,500 pts.

Source: RHB Securities Research - 19 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024