COMEX Gold - Still in Correction Mode

rhboskres

Publish date: Tue, 19 Jan 2021, 10:16 AM

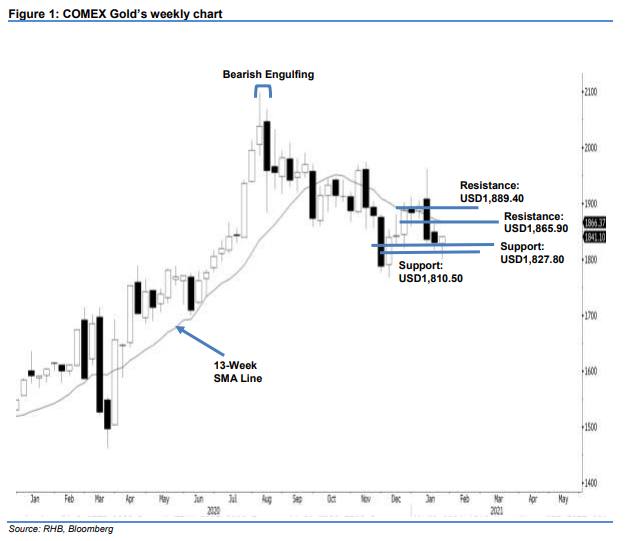

Maintain short positions. The COMEX Gold is moving lower, and remains in a correction phase. On a weekly basis, the precious metal is capped by the 13-week SMA line, which is trending lower, exerting selling pressure on the index. The overhead resistance level of USD1,865.90 is intersecting with the 13-week SMA line. A breach above this resistance level will result in a change of trend. Meanwhile, if the USD1,827.80 support level gives way, we will see more downside risks and a further extension of the downtrend. As the commodity is trading well below the 13-week SMA line, and exhibiting a “lower highs and lower lows” pattern, we keep our negative trading bias.

We recommend traders keep to short positions. We initiated these at USD1,908.60, or the closing level of 6 Jan. For risk management purposes, we set the trailing-stop above USD1,865.90.

Downside support is unchanged at 8 Jan’s low of USD1,827.80 and 2 Dec 2020’s USD1,810.50 low. On the upside, the immediate resistance is pegged at 17 Dec 2020’s low of USD1,865.90, followed by USD1,889.40.

Source: RHB Securities Research - 19 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024