FCPO - Rejection From MYR3,300

rhboskres

Publish date: Tue, 19 Jan 2021, 10:22 AM

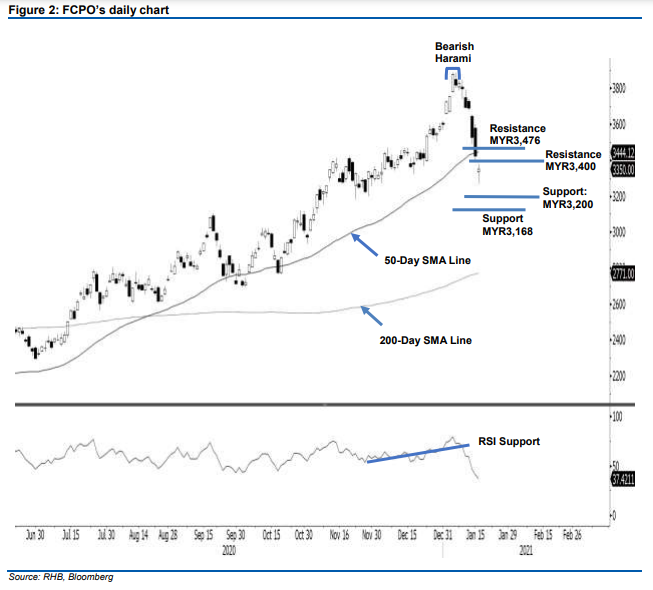

Maintain short positions. The FCPO rebounded higher on Monday, adding MYR28.00 to see Apr 2021’s futures contract settle at MYR3,350. Following a sell-off session last Friday, the commodity opened MYR15.00 higher at MYR3,337. After briefly testing the day’s high of MYR3,380, it fell towards the day’s low of MYR3,267 just before the end of the morning session. In the afternoon, buying interest emerged to lift the commodity off the day’s low, closing the day at MYR3,350 and forming a long lower shadow patten. The latest price action signals overwhelming buying pressure. Since the correction started from the Bearish Harami on 7 Jan 2021, this becomes the first reversal pattern printed on chart. If a follow through in the coming sessions occurs, and it breaches the upside resistance of MYR3,476, we should see a change in trend. However, until that happens, we maintain a negative trading bias.

We recommend that traders stick to short positions initiated at MYR3,695, or the closing level of 12 Jan. To manage risks, a trailing-loss is adjust to the MYR3,476 mark.

The immediate support is revised to MYR3,200, and followed by MYR3,168. Towards the upside, the immediate resistance is revised to MYR3,400 – this is followed by MYR3,476.

Source: RHB Securities Research - 19 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024