FKLI - Breaching The 50-Day SMA Line Support

rhboskres

Publish date: Tue, 19 Jan 2021, 10:23 AM

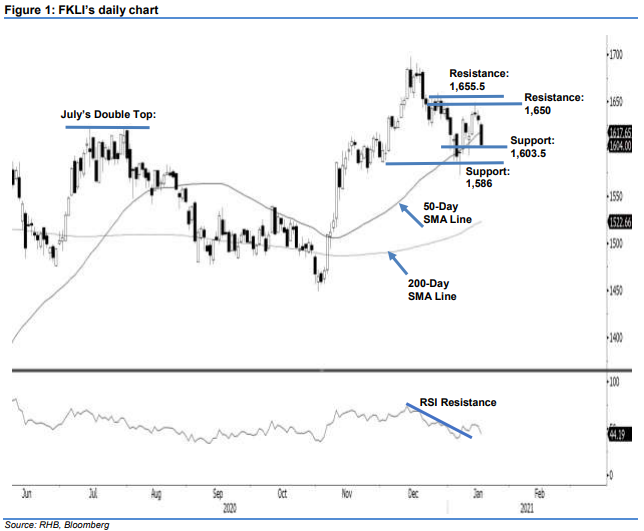

Maintain long positions. The FKLI saw a bearish session in the first trading day of the week, retracing 27 pts to settle at 1,604 pts. On Monday, the index gapped 5 pts lower to open at 1,626 pts. Accordingly, the gapping down was a Breakaway Gap and showed strong bearish sentiment. After the weak opening, the index drifted towards the day’s low of 1,602.5 pts and closed at 1,604 pts, just 0.5 pts away from the immediate support level. If the index breaches the immediate support of 1,603.5 pts, this may signal the end of its recent uptrend and the start of a downward correction. This is the third occasion where the index has settled below the 50-day SMA line over the past one month. To maintain an uptrend posture, the index needs to rebound off the 50-day SMA line. Since the index is currently above the stoploss level, we maintain a positive trading bias.

We recommend that traders maintain long positions. We initiated these at 1,630.5 pts – the closing level of 8 Jan. To manage downside risks, a stop loss can be set below the immediate support, ie 1,603.5 pts.

The immediate support is maintained at 7 Jan’s high of 1,603.5 pts, followed by 6 Jan’s low of 1,586 pts. Towards the upside, the resistance is pegged at 1,650 pts, followed by 29 Dec’s high of 1,655.5 pts.

Source: RHB Securities Research - 19 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024