FCPO - Falling Below The MYR3,300 Mark

rhboskres

Publish date: Wed, 20 Jan 2021, 05:56 PM

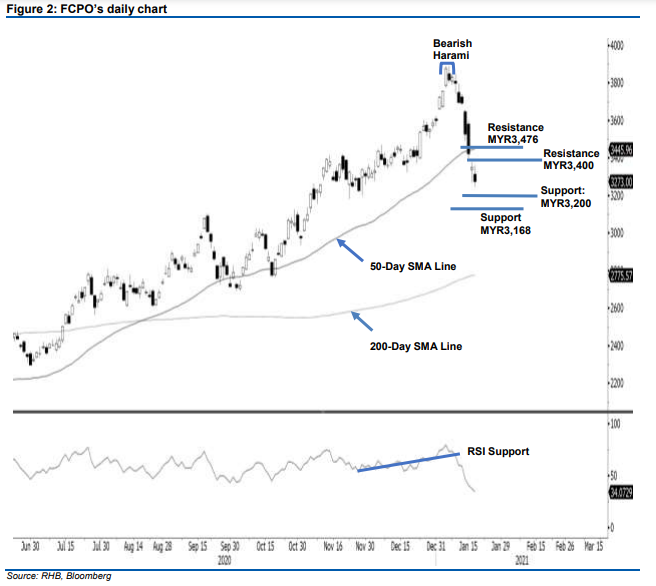

Maintain short positions. The FCPO came under selling pressure again on Tuesday, declining MYR83.00 to settle at MYR3,267. Following Monday’s Hammer pattern, it opened MYR36.00 lower at MYR3,314. During the morning session, the bulls struggled to stage a rebound, testing the MYR3,360 day high. However, the efforts were futile, and selling pressure emerged in the afternoon session, dragging the commodity towards the day low of MYR3,244. It was last traded at MYR3,273. At the latest price level, the commodity has pared gains accumulated since 1 Dec 2020, showing that bearish sentiment is overshadowing the bulls. Also, the latest bearish candlestick is negating the effect of the previous Hammer pattern. As it failed to find its footing with the Hammer pattern, it is likely that the commodity will extend its correction towards the MYR3,200 support level. Coupled with the RSI trending below 30%, whereby negative momentum is growing, we maintain our negative trading bias.

We recommend that traders stick to the short positions initiated at MYR3,695, or the closing level of 12 Jan. To manage risks, a trailing-stop can be set at the MYR3,476 mark.

The immediate support is maintained at MYR3,200, followed by MYR3,168. Towards the upside, the immediate resistance is pegged at the round figure of MYR3,400, followed by MYR3,476.

Source: RHB Securities Research - 20 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024