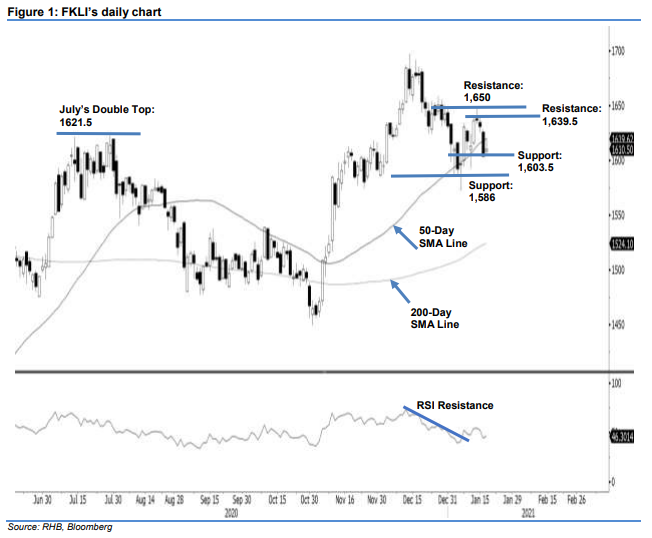

FKLI - Consolidating Near The 50-Day SMA Line

rhboskres

Publish date: Wed, 20 Jan 2021, 05:56 PM

Maintain long positions. The FKLI persisted by the overhead 50-day SMA line, as the bears took a breather yesterday, rebounding 6.5 pts to settle at 1,610.50 pts. The index gapped 4.5 pts higher to open at 1,608.50 pts. Selling pressure were seen at the day high of 1,620.50 pts, while buying pressure supported the index at the 1,605.50- pt day low. Based on latest price actions, the bulls and bears were at equal strength, consolidating just below the 50- day SMA line. Although the index is being capped by the 50-day SMA line, as long as there is no follow-through action that breaches the immediate support level, we will deem the uptrend structure as remaining intact. On the other hand, if the index falls below the immediate support, more selling pressure may be seen, and 6 Jan’s low of 1,586 pts is likely to be tested again. Until then, we maintain our positive trading bias.

We recommend that traders maintain long positions. We initiated these at 1,630.5 pts, or the closing level of 8 Jan. To manage downside risks, a stop-loss can be set below the immediate support level of 1,603.5 pts.

The immediate support is maintained at 7 Jan’s high of 1,603.5 pts, followed by 6 Jan’s low of 1,586 pts. Towards the upside, the resistance is pegged at 13 Jan’s high of 1,639.50 pts, followed by the 1,650-pt round figure.

Source: RHB Securities Research - 20 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024