WTI Crude - Attempting to Resume Advancement

rhboskres

Publish date: Wed, 20 Jan 2021, 05:57 PM

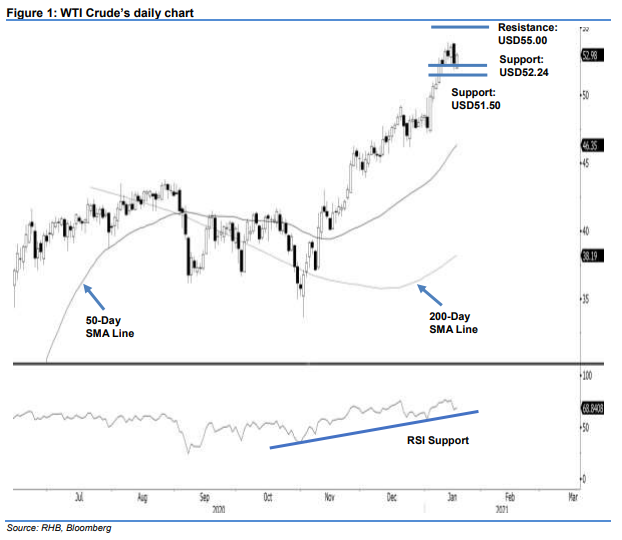

Maintain long positions. The WTI Crude ended the session in a positive tone, closing USD0.62 higher at USD52.98, not too far from the session’s high of USD53.13. The positive performance can be seen as an attempt by the bulls to end the commodity’s narrow consolidation phase, which started from the second half of last week, following the prior sharp one-week gains that hit the USD44.00-55.00 resistance zone. While we are of the view that the commodity’s positive price trend remains firm, the correction phase may still be able to extend into the coming 2-3 sessions – we are not expecting it to fall below the USD50.00 level before the commodity is ready to stage another attempt to test the said resistance zone. Maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop loss can be placed at the breakeven level.

The immediate support is expected to emerge at USD52.24 – the low of 14 Jan – followed by USD51.50. The overhead resistance is pegged at USD54.00, followed by the USD55.00 threshold.

Source: RHB Securities Research - 20 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024