FKLI - 50-Day SMA Line Still Capping Movement

rhboskres

Publish date: Thu, 21 Jan 2021, 05:35 PM

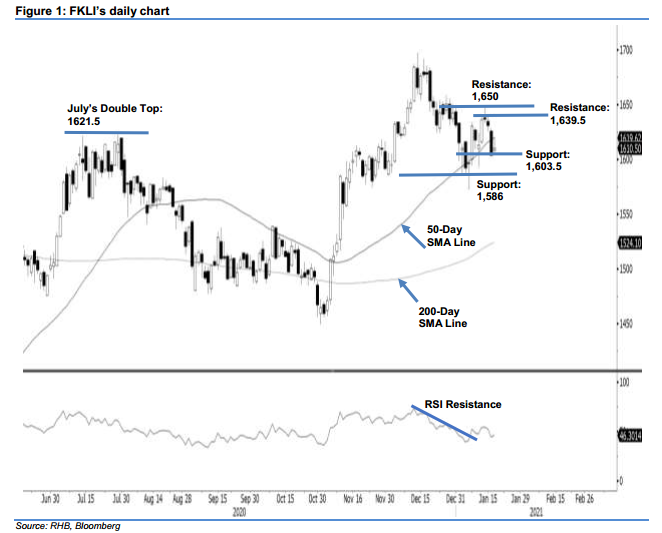

Maintain long positions. Bears trimmed positions near the 50-day SMA line yesterday, erasing 6 pts to close at 1,604.50 pts. Yesterday morning, the FKLI gapped down by 4 pts and opened at 1,606.50 pts, then rebounded towards the day’s high of 1,621 pts. Upon announcement of Bank Negara Malaysia’s latest monetary policy adjustment in the afternoon, the index reacted negatively and dropped towards the day’s low of 1,603.50 pts. While the bears dominated yesterday’s session, bulls also defended the baseline of 1,603.50 pts. If the immediate support level gives way in coming sessions, pessimism may rear upwards and we may see a further negative correction. On the other hand, if the index can rebound above the 50-day SMA, it should be on track for an uptrend. As the bulls are not giving up yet and the stop-loss remains intact, we maintain our positive trading bias.

We recommend that traders maintain long positions. We initiated these at 1,630.5 pts, or the closing level of 8 Jan. To manage downside risks, a stop-loss can be set below the immediate support level of 1,603.5 pts.

The immediate support is unchanged at 7 Jan’s high of 1,603.5 pts, followed by 6 Jan’s low of 1,586 pts. Towards the upside, the resistance is pegged at 13 Jan’s high of 1,639.50 pts, followed by the 1,650-pt round figure.

Source: RHB Securities Research - 21 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024