FCPO - Struggling To Find a Bottom

rhboskres

Publish date: Thu, 21 Jan 2021, 05:38 PM

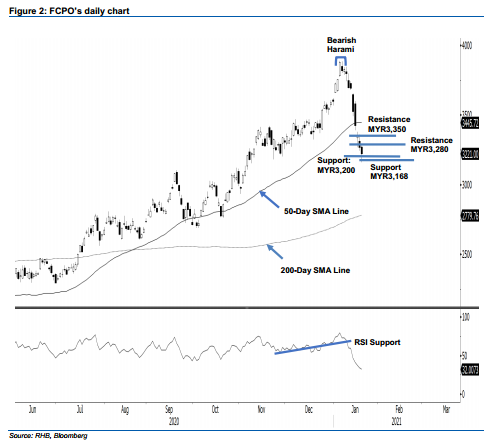

Maintain short positions. The FCPO underwent another bearish session, declining MYR46.00 to settle at MYR3,221. The commodity has been moving lower for the ninth consecutive session since the Bearish Harami was formed at the top. Yesterday, it opened MYR3.00 higher at MYR3,270, and rose the day’s high of MYR3,280. Shortly after touching the high, selling pressure dragging the commodity to the day’s low of MYR3,160. In the afternoon, the bulls were buying near the support levels of MYR3,200 and MYR3,168, and brought about a rebound. Based on the last 10 sessions, the average trading range (ATR) has widened to MYR80.00. Since the volatility has increased, and as the FCPO is trading at a level far apart from the 50-day SMA line, prices are very likely to revert to the mean in the coming sessions. As such, we will adopt a tighter stop-loss to trail the downtrend. By projecting at least a 1.5x ATR from the latest settlement price of MYR3,221, the latest trailing stop is set to be MYR3,350. Since the commodity is moving in a lower low trend, we stick to our negative trading bias.

We recommend that traders maintain short positions. Our short positions were initiated at MYR3,695, or the closing level of 12 Jan. To manage risks, trailing-stop has been adjusted to the MYR3,350 mark.

The immediate support is maintained at MYR3,200, followed by MYR3,168. Towards the upside, the immediate resistance is pegged at the recent high of MYR3,280, followed by the next hurdle of MYR3,350.

Source: RHB Securities Research - 21 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024