WTI Crude - Setting the Stage for the Next Upswing

rhboskres

Publish date: Fri, 22 Jan 2021, 05:52 PM

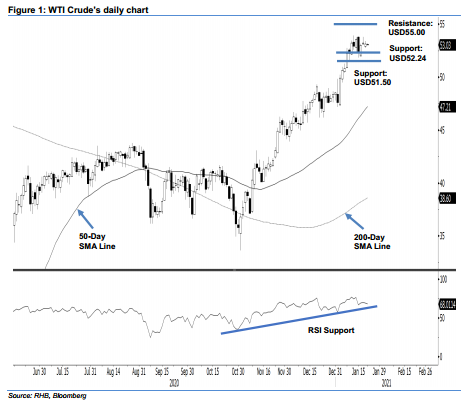

Maintain long positions. The WTI Crude traded in a directionless pattern during intraday trade, swinging between a low and high of USD52.75 and USD53.41, before ending USD0.11 softer at USD53.13. The performance was in line with our expectation that the commodity is still trading in a relatively narrow sideways range, following its previous price surge. Based on the latest sessions’ consolidation pattern, we believe there is a strong possibility of the commodity staging another attempt to test the USD54.00-USD55.00 resistance zone soon. Hence, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can be placed at the breakeven level.

We are keeping the immediate support at USD52.24 – the low of 14 Jan – followed by USD51.50. Moving up, the resistance is pegged at USD54.00, followed by the USD55.00 threshold.

Source: RHB Securities Research - 22 Jan 2021