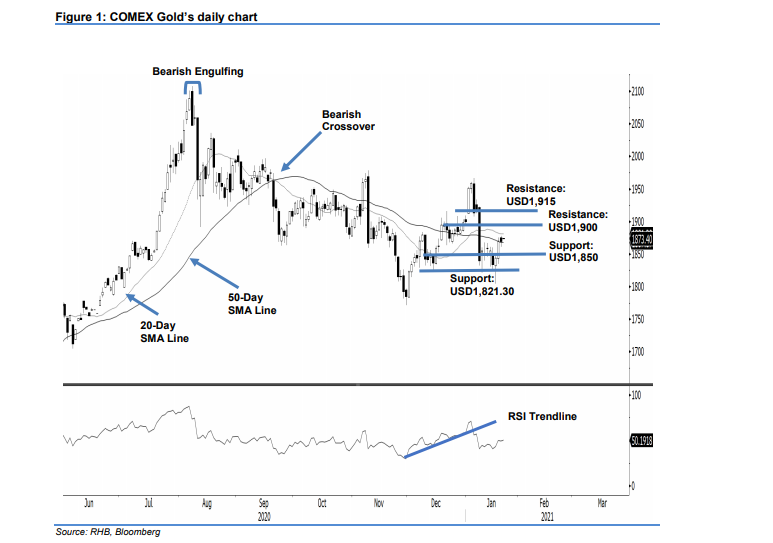

COMEX Gold - Consolidating Near the 50-Day SMA Line

rhboskres

Publish date: Fri, 22 Jan 2021, 05:53 PM

Maintain long positions. The COMEX Gold’s Apr 2021 futures contract is hovering at the 50-day SMA line, dipping USD0.90 to settle at USD1,869.30. Yesterday, it jumped USD5.40 to open at USD1,875.60. After reaching the day high of USD1,878.10, it corrected to the USD1,861.20 day low, and closed at USD1,869.30. If the commodity is able to consolidate near the 50-day SMA line, it will stand a chance to challenge the overhead resistance 20-day SMA line. A breach of the 20-day SMA line will see a resumption of the uptrend that started with the Bullish Crossover of moving averages on 4 Jan. Meanwhile, the RSI is returning to above the 50% threshold, indicating positive momentum is building. As long as the downside stop-loss remains intact, we will maintain our positive trading bias.

We recommend traders shift over to long positions, initiated at USD1,870.20, or the closing level of 20 Jan. For risk-management, we set the stop-loss at USD1,821.30.

Downside support is maintained at USD1,850 and11 Jan’s low of USD1,821.30. Towards the upside, the immediate resistance is pegged at the psychological level of USD1,900, followed by USD1,915.

Source: RHB Securities Research - 22 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024