FKLI - Downside Risk Still In Place

rhboskres

Publish date: Mon, 25 Jan 2021, 02:46 PM

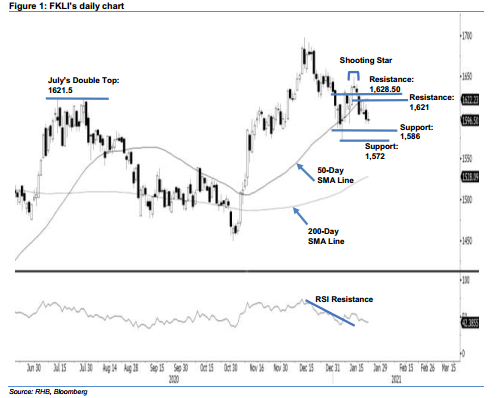

Maintained short positions. The FKLI has been tracking regional peers’ corrective movement, and dipped by 1.5 pts to close at 1,596.50 pts last Friday. It opened flat, at 1,598 pts. Early Friday morning, the index rebounded to test the day’s high of 1,607 pts, but shed gains in the afternoon and reached the day’s low of 1,592 pts. Sentiment still leans towards pessimism, and the bulls were weak. We think the index will continue to decline, and correct lower towards the possible trough range of 1,586-1,572 pts. The RSI is trending below 50%, pointing to bearish sentiment ahead. Any intra-day rebound should see a trend of lower highs and then lower lows. Without any positive reversal sign on the horizon, we maintain a negative trading bias.

We recommend traders to switch to short positions. Our short positions were initiated at 1,598 pts, or the closing level of 21 Jan. To manage downside risks, a stop-loss can be set above 1,623 pts.

The immediate support is marked at 6 Jan’s low of 1,586 pts, followed by 7 Jan’s low of 1,572 pts. Towards the upside, the resistance is unchanged at 20 Jan’s high of 1,621 pts, followed by 18 Jan’s high of 1628.50 pts.

Source: RHB Securities Research - 25 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024