WTI Crude - Upward Move Likely to Resume This Week

rhboskres

Publish date: Mon, 25 Jan 2021, 02:46 PM

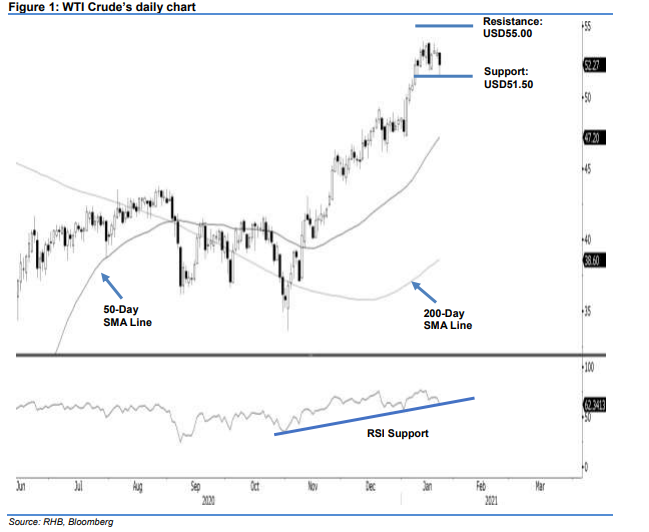

Maintain long positions. The WTI Crude managed to narrow its losses after testing the USD51.50 support level with a low of USD51.44. At the close, it settled USD0.86 weaker, at USD52.27. With the positive price reaction from the USD51.50 support level, we believe the commodity has likely completed its narrow 1.5-week consolidation phase, and that chances are high for it to resume its upward move this week. Towards the upside, we expect the USD54.00-USD55.00 resistance zone to be tested again. This positive expectation is also backed by the RSI reading, which has normalised to below the overbought threshold. We maintain our positive trading bias.

With the bias that the uptrend is likely to resume this week, we recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can be placed at the breakeven level.

Immediate support is revised to USD51.50, followed by USD50.00. Meanwhile, the immediate resistance is expected at USD54.00, followed by the USD55.00 threshold.

Source: RHB Securities Research - 25 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024