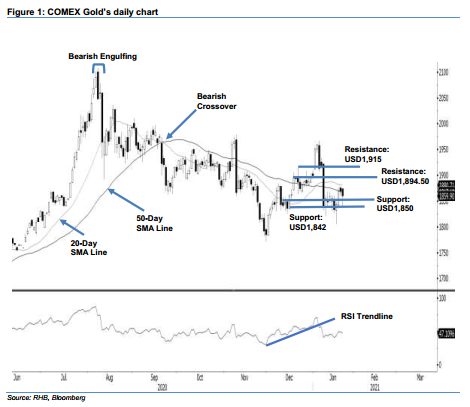

COMEX Gold - Retesting the 50-Day SMA Line

rhboskres

Publish date: Mon, 25 Jan 2021, 02:46 PM

Maintain long positions. The COMEX Gold’s Apr 2021 futures contract saw prices falling below the 50-day SMA line, erasing USD9.40 to settle at USD1,859.90. Last Friday, it opened USD4.70 higher at USD1,874. Once the session started, the commodity fell to the day low of USD1,839.70 before rebounding to close at USD1,859.90. Bullish pressure is supporting prices near the USD1,842 level. A dip below USD1,842 will see the resumption of the correction phase and further downward movement. Thus far, the commodity is still capped by the overhead 20-day SMA line. We think the precious metal will consolidate sideways between the 20-day SMA line and USD1,842 support level. A breakout from either boundary will see a new trend forming. As the downside stop-loss remains intact, we maintain our positive trading bias.

We recommend traders maintain long positions, which were initiated at USD1,870.20, or the closing level of 20 Jan. For risk management, we adjust the stop-loss higher to USD1,842.

The immediate support is marked at USD1,850, followed by the lower support at USD1,842. Towards the upside, the nearest resistance is pegged at the 17 Dec 2020’s closing level of USD1,894.50, followed by USD1,915.

Source: RHB Securities Research - 25 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024