FCPO - Attempting To Build An Interim Base

rhboskres

Publish date: Mon, 25 Jan 2021, 02:47 PM

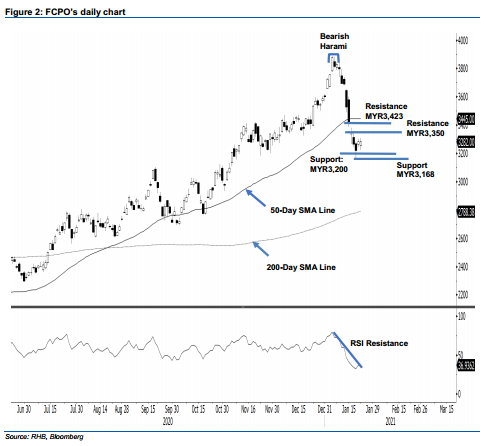

Maintain short positions. The FCPO was rather flat last Friday, dropping by MYR2.00 to settle at MYR3,282. The commodity gapped MYR29.00 lower to open at MYR3,255. It found a footing near the day’s low of MYR3,224. In the afternoon, it climbed towards the day’s high of MYR3,308, and last traded at MYR3,279. For the last five sessions, the bears overtook the bulls, and the commodity registered a series of closes reflecting lower lows. Although Friday’s session saw it closing higher than its opening price, the FCPO failed to record a higher price than previous sessions – indicating the lack of a follow-through momentum. Bears took over the market, preventing the commodity’s price from moving higher. A breakdown below the nearest support of MYR3,200 should trigger a further downward movement. On the other hand, a breakout of the RSI downtrend line or resistance may lead to a rebound in the immediate term, should the FCPO manage to build an interim base in the coming sessions. As long as the trailing stop stays intact, we stick to our negative trading bias.

We recommend that traders maintain short positions. Our short positions were initiated at MYR3,695, or the closing level of 12 Jan. To manage risks, a trailing-stop is set at the MYR3,350 mark.

The immediate support is unchanged at MYR3,200, followed by MYR3,168. Towards the upside, the immediate resistance is pegged at MYR3,350, followed by the next hurdle of MYR3,423.

Source: RHB Securities Research - 25 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024