FCPO - Consolidating At An Interim Base

rhboskres

Publish date: Tue, 26 Jan 2021, 02:47 PM

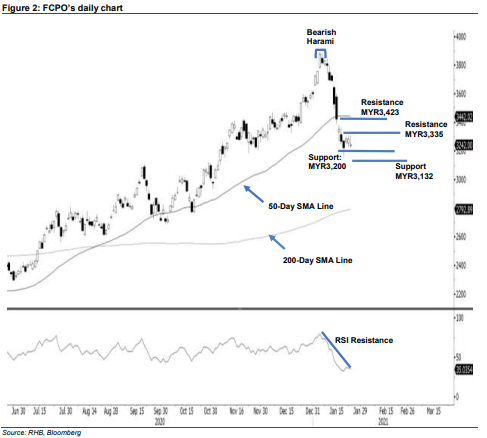

Maintain short positions. The FCPO dipped lower on Monday, retracing MYR40.00 to settle at MYR3,242. The commodity gapped MYR44.00 lower to open at MYR3,238. Buying pressure emerging near the day’s low of MYR3,218, which resulted in the commodity climbing to the day’s high of MYR3,307. Intraday profit taking was seen in the afternoon, with the commodity retracing lower, ending the day at MYR3,239. Based on the latest price action, the commodity is consolidating near the support level of MYR3,200. If it breaks below the physcological level of MYR3,200, it may test the lower support at MYR3,132. On the other hand, if it manages to build an interim base, and breach the immediate resistance of MYR3,335, it may stage a meaningful counter trend rebound, and test the gap resistance or closing level of 15 Jan at MYR3,423. Based on the latest RSI reading, the commodity is capping by the downtrend line, and will likely to see negative momentum ahead. As long as the trailing stop remains intact, we stick to our negative trading bias.

We recommend that traders stick to short positions. Our short positions were initiated at MYR3,695, or the closing level of 12 Jan. To manage risks, a trailing-stop is revised to MYR3,335 mark.

The immediate support is kept at MYR3,200 while we revise the lower support to MYR3,132. Towards the upside, the immediate resistance is pegged at MYR3,335, followed by the next hurdle of MYR3,423.

Source: RHB Securities Research - 26 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024