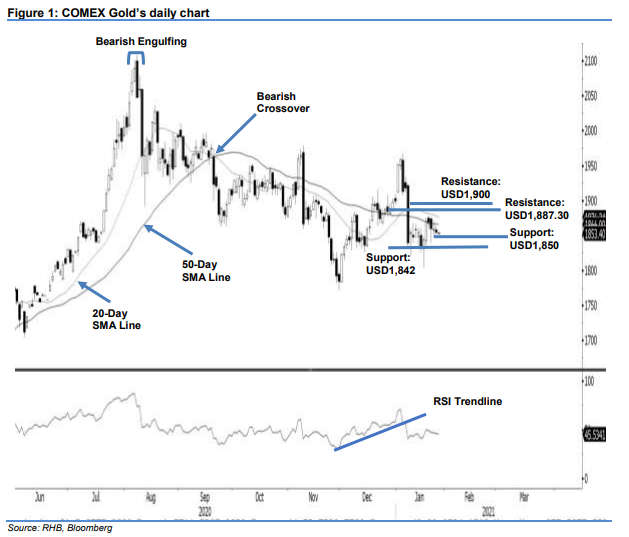

COMEX Gold - Inching Away From the 50-Day SMA Line

rhboskres

Publish date: Wed, 27 Jan 2021, 02:00 PM

Maintain long positions. The COMEX Gold’s April futures contract saw another neutral session on Tuesday, dipping USD4.20 to settle at USD1,854.80. After a flat opening at USD1,858.70, the precious metal bounced inbetween the USD1,864.50 day high and day low of USD1,851.10 before settling at USD1,854.80. Pending an interest rate decision to be announced by the US Fedeal Reserve on Wednesday evening, we expect the commodity to continue being range-bound between the 20-day SMA line and USD1,842 support level. A breakout of either boundary will see the volatility increase, as well as the start of a new trend. Since the stop loss remains intact, we maintain our positive trading bias.

We recommend traders maintain long positions, which were initiated at USD1,870.20, or the closing level of 20 Jan. For risk management, stop loss can be placed at the USD1,842 level.

The immediate support is unchanged at USD1,850 and followed by the lower support at USD1,842. Towards the upside, the nearest resistance is pegged at 29 Dec 2020’s closing level of USD1,887.30 – this is followed by the USD1,900 threshold.

Source: RHB Securities Research - 27 Jan 2021