E-Mini Dow - No Reversal Signals

rhboskres

Publish date: Wed, 27 Jan 2021, 02:46 PM

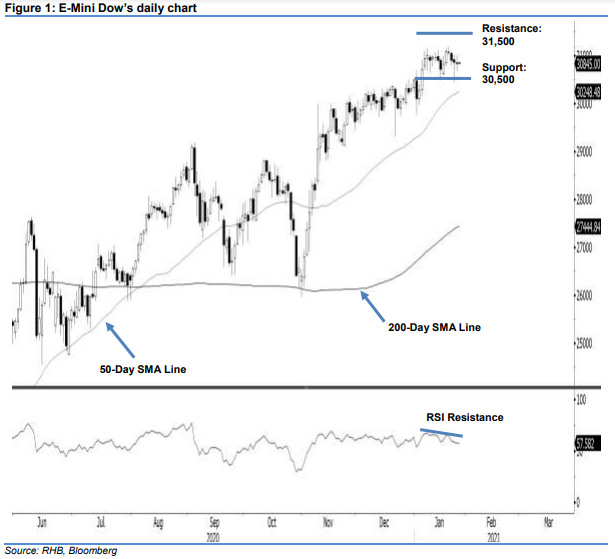

Maintain long positions. The E-Mini Dow started the session on a weak footing, entering the European trading hours generally trending lower, reaching a low of 30,666 pts. From there, the index rebounded to a high of 31,017 pts before settling 26 pts softer at 30,842 pts. The performance suggests a cautious market environment ahead of the US Federal Open Market Committee’s interest rate decision later today. While its recent weeks’ weak momentum is obvious, in the absence of negative price signals, the E-Mini Dow’s positive price trajectory remains firmly in place. Towards the downside, the risk of a deeper correction phase setting in will still be low, provided the 30,500-pt support level is not breached. Premised on these factors, we keep to our positive trading bias.

We recommend traders stay in long positions for now. We initiated these at 30,033 pts, or the closing level of 11 Dec 2020. For risk-management purposes, a stop loss can now be set at the breakeven mark.

We made no changes to our support levels: 30,750 pts and 30,500 pts. Conversely, the immediate resistance is pegged at 31,188 pts – the record intraday high posted on 21 Jan. This is followed by 31,500 pts.

Source: RHB Securities Research - 27 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024