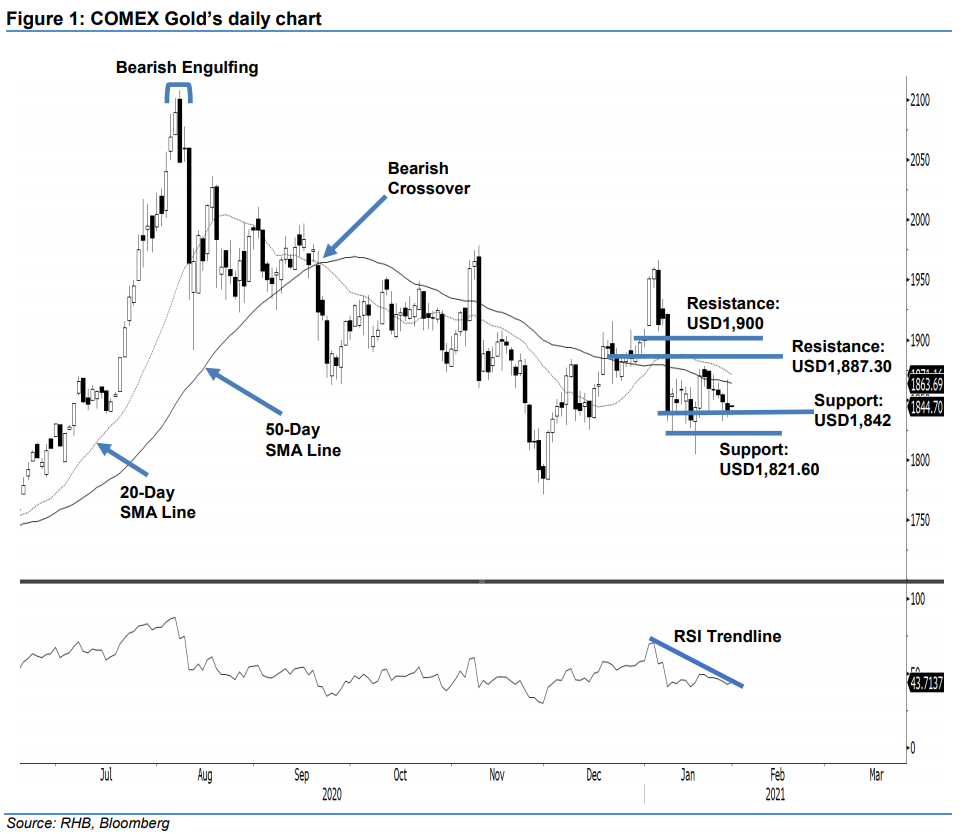

COMEX Gold - Blocked by the 50-Day SMA Line

rhboskres

Publish date: Fri, 29 Jan 2021, 12:51 PM

Maintain long positions. The COMEX Gold’s latest rebound was capped by the 50-day SMA line, erasing USD1.10 to settle at USD1,847.80. On Thursday, the April contract opened flat at USD1,847.80. After touching the day’s low of USD1,839, the commodity rebounded towards the day’s high of USD1,869.60, testing the 50-day SMA line. However, in the final trading hour, it retraced its gains to close at USD1,847.80, leaving an Inverted Hammer pattern. The next three trading sessions will be crucial, as we foresee the 20-day SMA line may cross below the 50-day SMA line. If a Bearish Crossover does happen, we expect more selling pressure. Meanwhile, the precious metal should move sideways for further consolidation until either the 20-day SMA line or support level of USD1,842 is breached. With the stop-loss remaining intact, we maintain our positive trading bias.

We recommend traders maintain their long positions, initiated at USD1,870.20, or the closing level of 20 Jan. For risk management, a stop-loss can be placed at USD1,842.

The immediate support remains at USD1,842, followed by 11 Jan’s low of USD1,821.60. Towards the upside, the nearest resistance is pegged at 29 Dec 2020’s closing level of USD1,887.30, followed by the USD1,900 threshold.

Source: RHB Securities Research - 29 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024