E-Mini Dow - Support Zone Holding Up

rhboskres

Publish date: Fri, 29 Jan 2021, 12:51 PM

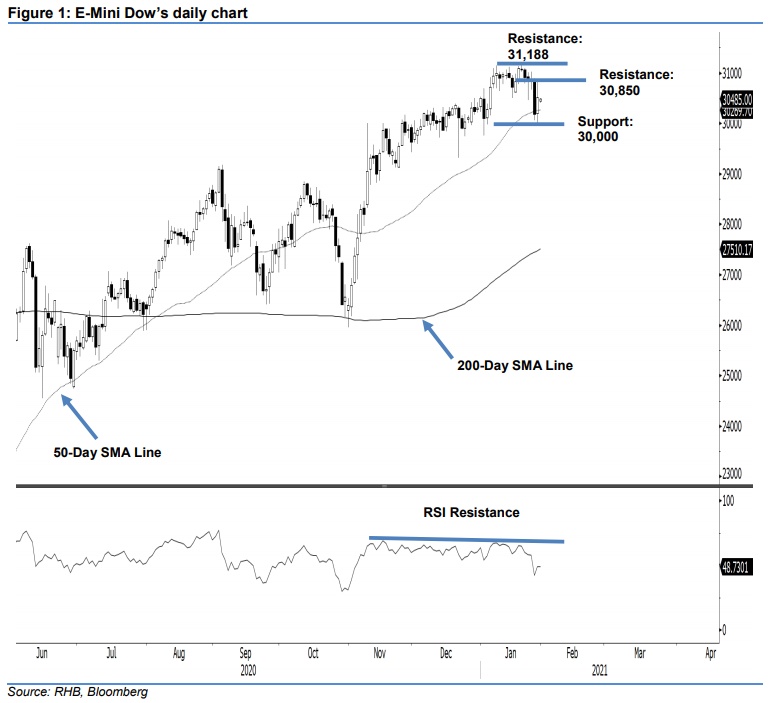

Maintain long positions. After one of its weakest sessions in weeks on Wednesday, the E-mini Dow rebounded during the latest session. This was after testing a support zone made up of the 30,000-pt psychological level and the 50-day SMA line, with a low of 29,950 pts. At the close, the index settled 318 pts higher at 30,507 pts – off the day’s high of 30,843 pts. While we have highlighted multiple times, our observation that the index’s recent weeks’ upward movements lacked momentum, as long as the 30,000-pt support level is not breached, the risk of the index halting its multi-month upward move should be contained. Towards the downside, if the 30,000-pt support level fails to hold up, the index will likely retrace towards the 29,000-pt area. For now, we keep our positive trading bias.

We recommend traders stay in long positions for now. We initiated these at 30,033 pts, or the closing level of 11 Dec 2020. For risk-management purposes, a stop loss can now be set at the breakeven mark.

Support levels are revised to 30,000 pts, followed by 29,750 pts. On the upside, the immediate resistance is now set at 30,850 pts, followed by 31,188 pts – the record intraday high posted on 21 Jan.

Source: RHB Securities Research - 29 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024