WTI Crude - Extending Its Narrow Consolidation Phase

rhboskres

Publish date: Fri, 29 Jan 2021, 12:51 PM

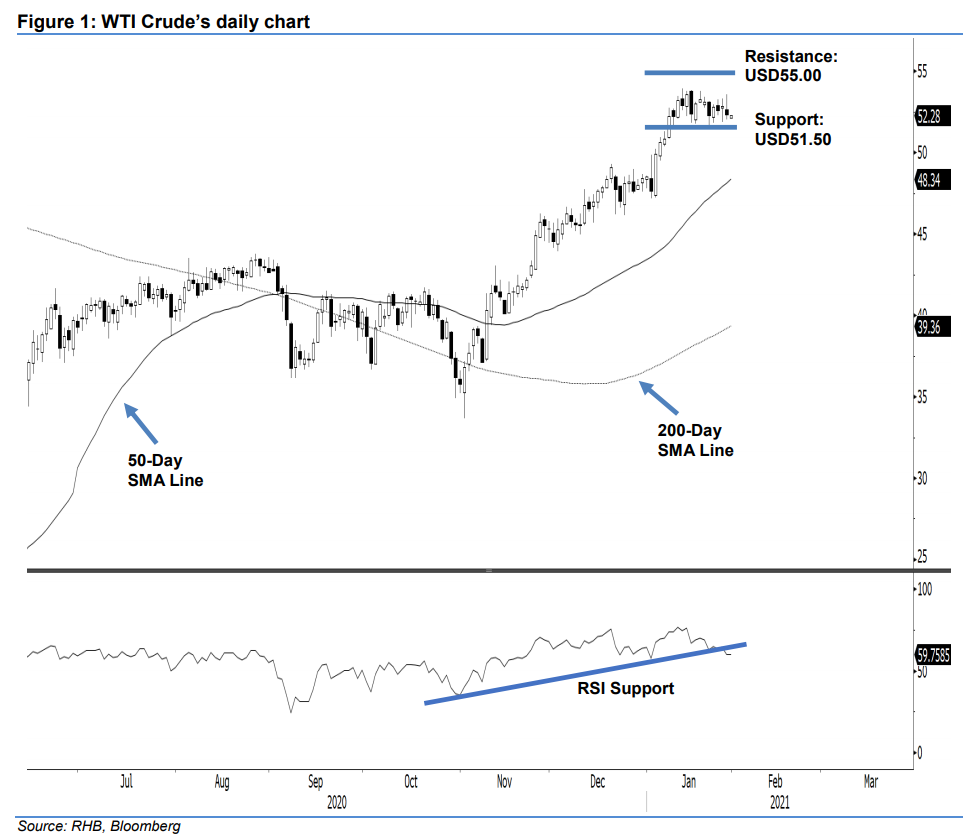

Maintain long positions. The WTI Crude was unable to hold on to its intraday gains, settling USD0.51 weaker at USD52.34. The high was posted at USD53.58. The weak performance means our expectation for the commodity to stage another attempt to test the USD54.00-55.00 resistance zone this week, still has not materialised. Even if the commodity is to extend its minor sideways trading, as long as the USD50.00 psychological level is not breached, the black gold’s multi-month uptrend would still be considered as intact. We are not overly concerned with the RSI, which has crossed below its support line, as it merely reflects the ongoing minor consolidation. We maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can be placed at the breakeven level.

The immediate support is maintained at USD51.50, followed by the USD50.00 psychological level. On the upside, the immediate resistance is set at USD54.00, followed by the USD55.00 threshold.

Source: RHB Securities Research - 29 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024