WTI Crude - Moving Towards the Resistance Zone

rhboskres

Publish date: Tue, 02 Feb 2021, 11:47 AM

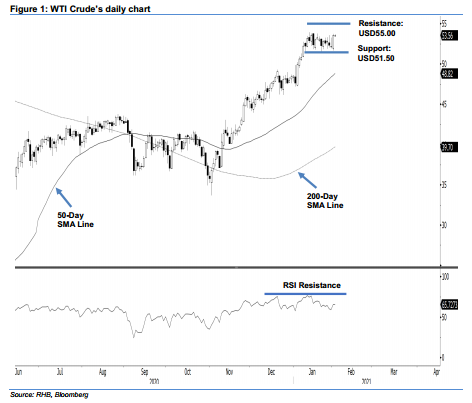

Maintain long positions. The WTI Crude was under the control of the bulls during the latest session. It generally moved higher for the entire session to form a white candle, adding USD1.35 to close at USD53.55, with the high was posted at USD53.74. The positive performance placed the commodity within striking distance of testing the USD54.00-55.00 resistance zone for the second time – our expectation for the past two weeks. An upside breach of this zone is crucial in signalling an end to the commodity’s narrow sideways consolidation phase – hence opening the door for the multi-month upward move to extend. Premised on this, we are keeping to our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop loss can be placed at the breakeven level.

The immediate support is revised to USD52.50 and followed by USD51.50. Conversely, the immediate resistance is set at USD54.00 and followed by the USD55.00 threshold.

Source: RHB Securities Research - 2 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024