FCPO - Re-Crossing The 50-Day SMA Line

rhboskres

Publish date: Tue, 02 Feb 2021, 11:47 AM

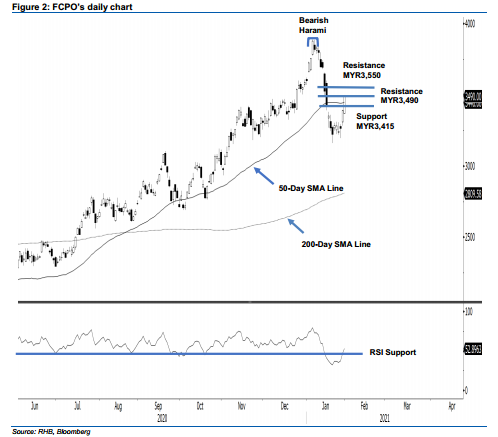

Tagging the rebound extension; maintain long positions. The FCPO is showing good signs of extending its rebound. The commodity generally trended higher for the Friday session, from a low of MYR3,365, to a high of MYR3,495 before closing MYR102 stronger at MYR3,490. The closing level placed the commodity back above the 50- day SMA line – a positive observation. We have yet to spot any price exhaustion signal to the ongoing rebound. Towards the upside, there is a good possibility for the commodity to travel towards MYR3,600, ie the 61% Fibonacci retracement – measured between 6 Jan’s high of MYR3,888 and 20 Jan’s low of MYR3,160. Premised on this, we are keeping our positive trading bias.

As the rebound is still developing, we advise traders to stay in long positions. We initiated these at MYR3,388 – the closing level of 27 Jan. To manage risks, a stop-loss is placed below MYR3,350.

Support levels are pegged at MYR3,450 and MYR3,415. On the upside, the immediate resistance is now eyed at MYR3,490, followed by MYR3,550.

Source: RHB Securities Research - 2 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024