WTI Crude - Attempting a Breakout From the Resistance Zone

rhboskres

Publish date: Wed, 03 Feb 2021, 05:59 PM

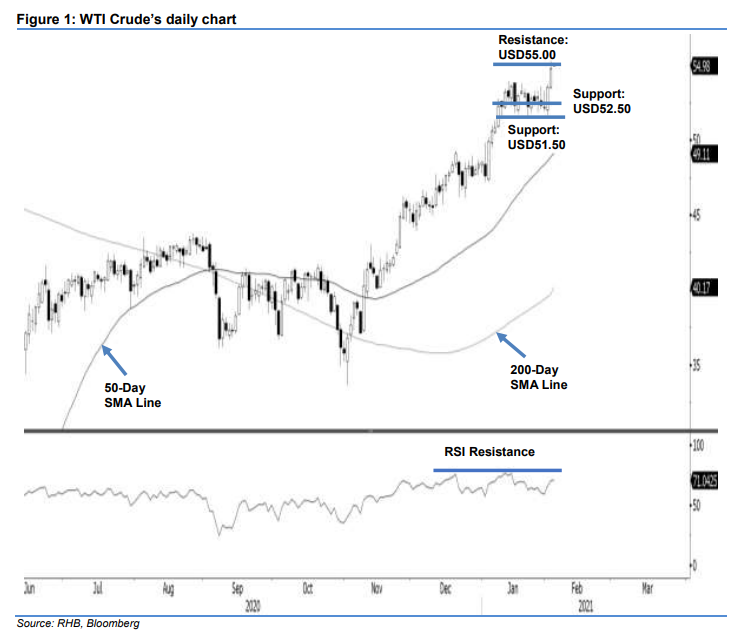

Maintain long positions while moving up the trailling-stop. After consolidating for about two weeks, the WTI Crude finally made an attempt to break out from the USD54.00-USD55.00 resistance zone. Entering the North America trading hours, the black gold generally trended higher. It briefly breached above the said resistance zone, with a high of USD55.26, before returning some of the gains to settle USD1.21 higher at USD54.76. While not able to sustain its intraday breakout from the resistance zone, intraday price actions did not suggest a price rejection signal. Towards the upside, a breakout could see prices travelling towards the USD57.00-USD60.00 area. We maintain our positive trading inclination.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can now be placed below the USD51.50 level.

The immediate support is revised to USD53.80, followed by USD52.50. On the upside, the immediate resistance is set at USD55.00, and followed by USD57.00.

Source: RHB Securities Research - 3 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024