FCPO - Rebound Taking a Pause

rhboskres

Publish date: Wed, 03 Feb 2021, 06:00 PM

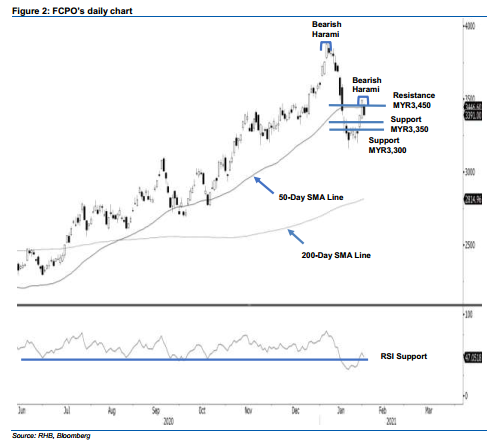

Maintain long positions. After a weak opening, the FCPO generally moved lower for the entire session. It hit a low of MYR3,385, before shedding MYR99 to close at MYR3,391 – reverting below the 50-day SMA line. As a result, a “Bearish Harami” was formed. These negative technical observations suggest that the commodity is merely experiencing some profit taking following the previous three sessions’ sharp gains. As long as the MYR3,350 support level is not breached, the FCPO should extend its rebound towards the MYR3,600 area – being the 61% Fibonacci retracement – measured between 6 Jan’s high of MYR3,888 and 20 Jan’s low of MYR3,160. Maintain our positive trading bias.

As the rebound is still developing, we advise traders to stay in long positions. We initiated these at MYR3,388 – the closing level of 27 Jan. To manage risks, a stop-loss is placed below MYR3,350.

Support levels are revised to MYR3,350 and MYR3,300. Meanwhile, the immediate resistance is now pegged at MYR3,420, followed by MYR3,450.

Source: RHB Securities Research - 3 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024