E-Mini Dow - Rebound Pausing

rhboskres

Publish date: Thu, 04 Feb 2021, 06:07 PM

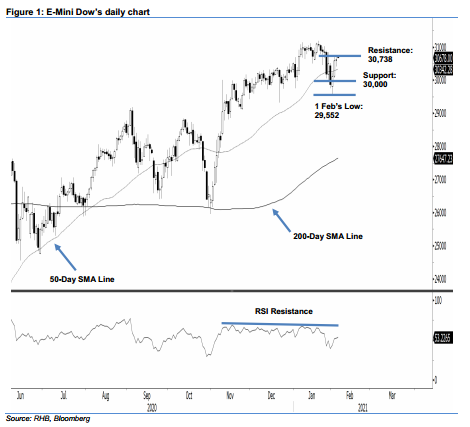

Pending a positive follow-through, maintain short positions. The E-Mini Dow’s sharp rebound off the 29,552- pt low on 1 Feb over the previous two sessions indicated a pause sign during Wednesday’s trading. During the intraday, the index traded in a flat pattern without showing any clear directional bias – it was in a 30,412-30,720-pt range – before closing 41 pts higher at 30,627 pts. While the latest performance did not indicate signs of a price reversal – and the E-Mini Dow is still trading above the 50-day SMA line – we believe prices have to breach above 30,738 pts for the index to signal an end to its ongoing correction phase and resumption of the multi-month uptrend. For now, we are keeping to our negative trading bias.

We recommend traders stay in short positions. We initiated these at 30,110 pts, ie the closing level of 1 Feb. For risk-management purposes, a stop loss can be set above 30,738 pts.

We are keeping the immediate support target at 30,300 pts, followed by the 30,000-pt psychological level. On the upside, the immediate resistance is expected at 30,738 pts – the high of 2 Feb – and followed by 30,850 pts.

Source: RHB Securities Research - 4 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024