WTI Crude - Marching Towards the Next Price Zone

rhboskres

Publish date: Thu, 04 Feb 2021, 06:08 PM

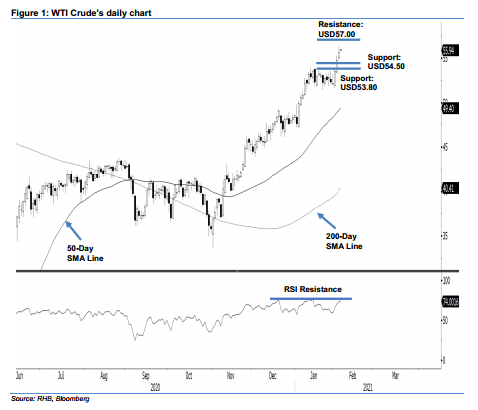

Maintain long positions while adjusting the tralling stop upward. The WTI Crude formed its third consecutive white candle to break away from the USD54.00-55.00 resistance zone. For the day, the black gold generally trended higher, reaching a USD56.33 high before giving back some of the gains – it settled USD0.93 higher at USD55.69. While its daily trading range has narrowed – vis-à-vis the previous two sessions, which suggests the bulls may be slowing down their pace on an overbought RSI reading – the positive close still signals the bulls are in firm control over the commodity. The latest three sessions’ gains came following the recent completion of the WTI Crude’s 2- week sideways consolidation phase. Towards the upside, we set our sights on prices entering the next price zone: USD57.00-60.00. We maintain our positive trading bias

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop loss can now be placed below the USD52.50 level.

The immediate support is revised to USD54.50 and followed by USD53.80. Conversely, the immediate resistance is set at USD57.00, followed by USD60.00

Source: RHB Securities Research - 4 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024