FCPO - Retracement May Be Resuming

rhboskres

Publish date: Thu, 04 Feb 2021, 06:08 PM

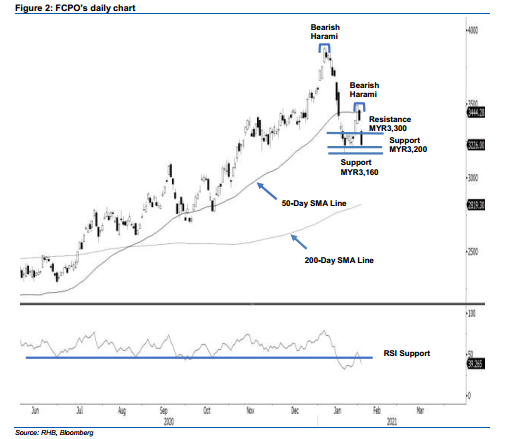

Initiate short positions. After gapping down at the opening, the FCPO grasps at straws to find a way to stop the selling pressure as it generally moved lower throughout the session. It hit a low of MYR3,210 before ending the day MYR166 weaker at MYR3,226. The negative performance was a follow-through from the previous session’s “Bearish Harami” formation which saw prices breach below the 50-day SMA line. This has nullified our expectation for the commodity to extend its rebound towards the MYR3,600 area. On the same token, we highlight that the risk is high for the correction phase, which started from early January, to resume. Given the latest two session’s sharp declines, a minor pause may take place in the coming session. As such, we switch our trading bias from positive to negative as the next bigger move is tilted towards the downside.

Our previous long positions initiated at MYR3,388 – the closing level of 27 Jan – were closed out in the latest session. Concurrently, we initiate short positions at the closing level. To manage risks, a stop-loss can be placed above MYR3,300.

Support levels are revised to MYR3,200 and MYR3,160 – the low of 20 Jan. On the upside, the immediate resistance is now set at MYR3,265, followed by MYR3,300.

Source: RHB Securities Research - 4 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024