WTI Crude - Bulls Are Pushing Ahead

rhboskres

Publish date: Fri, 05 Feb 2021, 04:59 PM

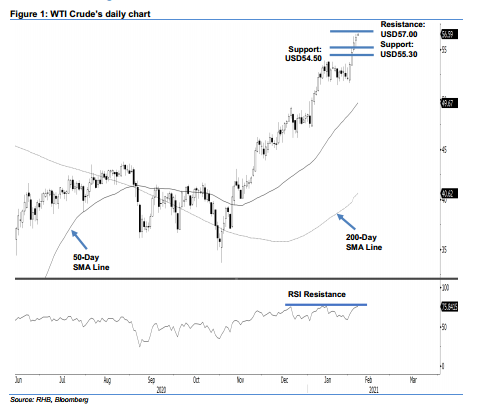

Maintain long positions. The WTI Crude extended its winning streak into the fourth consecutive session, adding USD0.54 to close at USD56.23. The gains largely came during the latter part of the session, after the commodity completed a minor intraday consolidation, which saw prices dip to a low of USD55.30. The positive performance is a follow-through from the previous session’s breakout from the previous USD54.00-USD55.00 resistance zone. In line with our expectation, the bulls have slowed down their rate of advancement, with the daily trading range narrowed for the second consecutive session - on the back of an overbought RSI reading. However, in the absence of a price reversal, or exhaustion signals around the USD57.00-USD60.00 resistance zone, we keep our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can now be placed below the USD52.50 level.

The immediate support is revised to USD55.30, followed by USD54.50. On the upside, the immediate resistance is set at USD57.00, followed by USD60.00

Source: RHB Securities Research - 5 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024