WTI Crude: Tightening Up Risk Management

rhboskres

Publish date: Mon, 08 Feb 2021, 10:13 AM

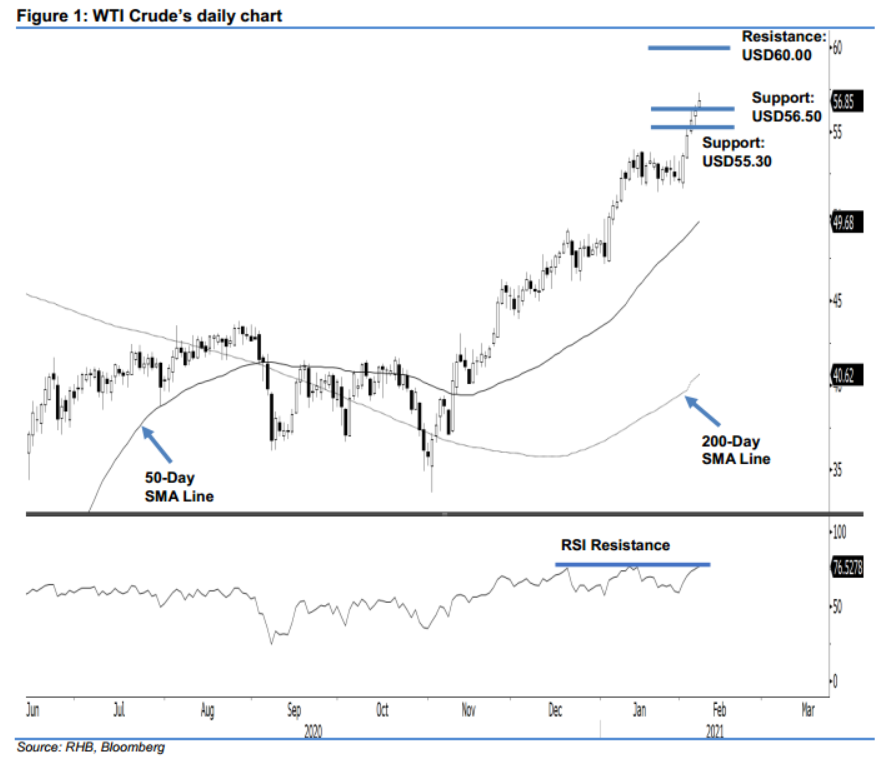

Maintain long positions. The WTI Crude tested the USD57.00-USD60.00 resistance zone during the latest session, as it reached a high of USD57.29, before ending USD0.62 higher at USD56.85. While it was unable to sustain its intraday breach of the USD57.00 immediate resistance level, we are not seeing price rejection signals. Price actions around the said resistance zone, in the coming sessions, are crucial to define the commodity’s next price directional bias. This is as the commodity is increasingly prone to a technical pullback – or developing a consolidation phase – on the back of the overbought RSI readings. Until such negative price signals appear, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can now be placed below the USD54.00 level.

The immediate support is revised to USD56.50, followed by USD55.30. Conversely, the immediate resistance is set at USD57.00, followed by USD60.00.

Source: RHB Securities Research - 8 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024