WTI Crude : Trading Within the Resistance Zone

rhboskres

Publish date: Tue, 09 Feb 2021, 10:30 AM

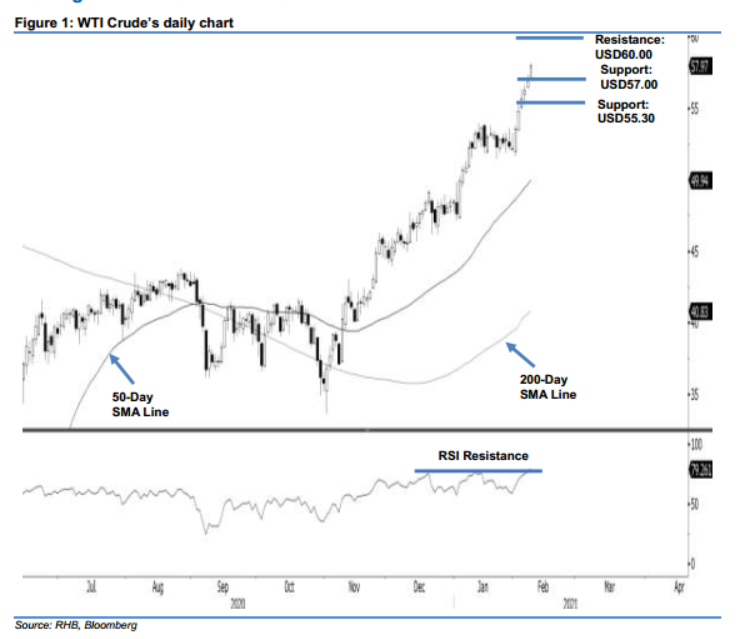

Maintain long positions while moving up the trailing-stop. The WTI Crude kicked-off the week by extending last week’s winning streak, despite the RSI continuing to flash overbought readings. The intraday trend was positive, with the commodity consistently moving higher – hitting a high of USD58.18 before ending USD1.12 higher at USD57.97. Its overbought RSI has also crossed above the resistance line (as depicted in the chart), suggesting that price momentum is still strong. However, it worth noting that the past week’s sharp upward move has turned unhealthy, making the commodity susceptible to a technical pullback. Until we see signs of this taking place, we will keep our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can now be placed below the USD57.00 level.

Support levels are revised to USD57.00 and USD55.30. On the upside, the immediate resistance is set at USD60.00, and followed by USD62.00.

Source: RHB Securities Research - 9 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024