WTI Crude: Bulls Still Win the Day

rhboskres

Publish date: Wed, 10 Feb 2021, 04:39 PM

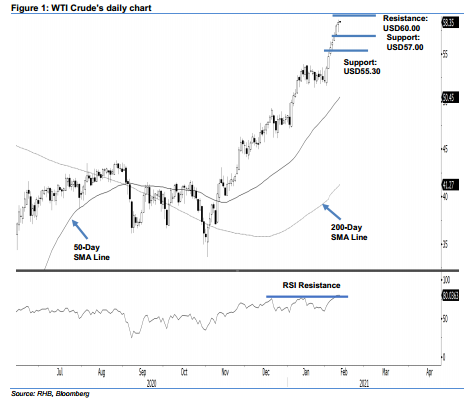

Maintain long positions. The WTI Crude experienced a roller-coaster ride. Transitioning into European trading hours, the black gold traded on an encouraging note – hitting a high of USD58.62. From that point, it slid to a low of USD57.27, before rebounding to settle USD0.39 higher at USD58.36. The closing level was the highest since mid-Jan 2020. Despite registering a daily gain – based on the intraday price actions – there is high possibility of the commodity developing a minor consolidation phase. This is warranted, given the past 1.5 weeks’ sharp gains, which have pushed the commodity into the USD57.00-60.00 resistance zone – and thrusted the RSI into an overbought reading zone. Towards the downside – provided the USD57.00 support level is not breached – we will be maintaining our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can now be placed below the USD57.00 level. Support levels are maintained at USD57.00 and USD55.30. Meanwhile, the immediate resistance is expected at USD60.00, and followed by USD62.00.

Source: RHB Securities Research - 10 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024