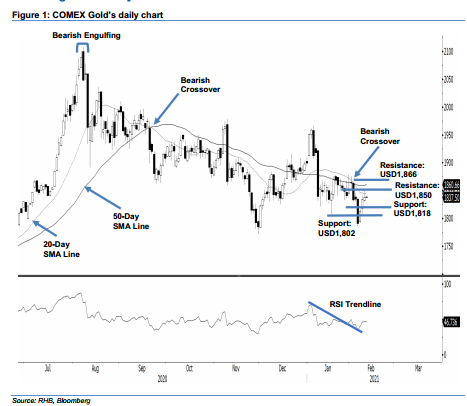

COMEX Gold: Touching the 20-Day SMA Line

rhboskres

Publish date: Wed, 10 Feb 2021, 04:41 PM

Maintain long positions. The COMEX Gold saw profit-taking near the 20-day SMA line, but gained USD3.30 to settle at USD1,837.50. The commodity rose to the day’s high of USD1,849.50, after opening at USD1,832.40. However, the downward movement of the 20-day SMA line was too strong, resulting in the commodity retracing to close at USD1,837.50. While it managed to end the session higher, the commodity left a Shooting Star pattern – indicating that selling pressure is emerging near the 20-day SMA line. We move the stop-loss higher to trail the precious metal’s price. As mentioned in the previous note, the commodity has to cross the nearest resistance point, sighted at USD1,850, to extend the rebound. As the stop-loss remains intact, we deem the counter-trend rebound phase as still in play. We maintain our positive trading bias.

We recommend traders to shift over to long positions, initiated at USD1,834.20 or the closing level of 8 Feb. For risk management purposes, the stop-loss is raised to USD1,802.

The immediate support is marked at USD1,818, followed by USD1,802. Towards the upside, the nearest resistance is pegged at the USD1,850 round figure, followed by USD1,866.

Source: RHB Securities Research - 10 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024