FCPO : Meeting Minimum Rebound Target

rhboskres

Publish date: Wed, 10 Feb 2021, 05:02 PM

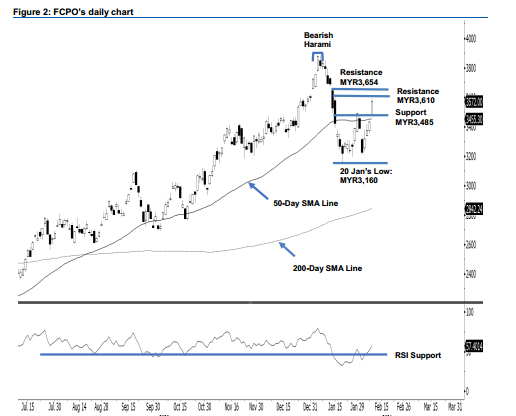

Maintain long positions. The FCPO kicked off yesterday’s session with an “Upside Gap” to pierce through the 50-day SMA line. This was followed by consistently higher highs for the remainder of the day. The commodity reached a high of MYR3,595, before closing MYR137.00 stronger at MYR3,572. The performance has met our minimum expectation for the commodity to retest 2 Feb’s “Bearish Harami” high of MYR3,495. While the rebound has come close to the significant 61.8% Fibonacci retracement level of MYR3,610 (measured between 6 Jan’s high of MYR3,888 and 20 Jan’s low of MYR3,160), intraday price actions did not signal a price reversal or rejection. Premised on this, we make no change to our positive trading bias.

We recommended that traders stay in long positions. We initiated these at MYR3,317, the closing level of 4 Feb. To manage risks, a stop-loss can now be placed below MYR3,350.

We are now expecting the support level to emerge at MYR3,535, followed by MYR3,485 – both are the latest session’s price points. Towards the upside, the immediate resistance is pegged at MYR3,610 – the 61.8% retracement level, and followed by MYR3,654, which is the high of 14 Jan.

Source: RHB Securities Research - 10 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024