WTI Crude - Possible Signs of a Pause

rhboskres

Publish date: Wed, 17 Feb 2021, 10:43 AM

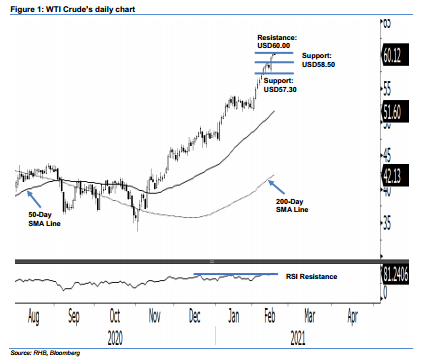

Maintain long positions, while nudging up trailing-stop. After reaching a high of USD60.33 during the Asian trading hours, the black gold dipped into negative territory with a low of USD59.33, before closing USD0.58 stronger at USD60.05. The intraday price actions indicate that the commodity may be taking a pause, following its recent weeks’ sharp gains, which pushed the RSI past the overbought threshold. Also, as highlighted in our note yesterday, the commodity is currently trading around the multi-year downtrend line. While we have a bias that some form of a correction phase is likely to develop, pending price confirmation, we are keeping our positive trading bias while tightening up our risk management.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can now be placed below the USD57.50 level.

The support level is maintained at USD58.50, followed by USD57.30. Conversely, the immediate resistance is still pegged at USD60.00 – as it was not decisively crossed in the latest session – and followed by USD62.00.

Source: RHB Securities Research - 17 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024