FKLI - Approaching Last Line Of Defence

rhboskres

Publish date: Thu, 18 Feb 2021, 10:48 AM

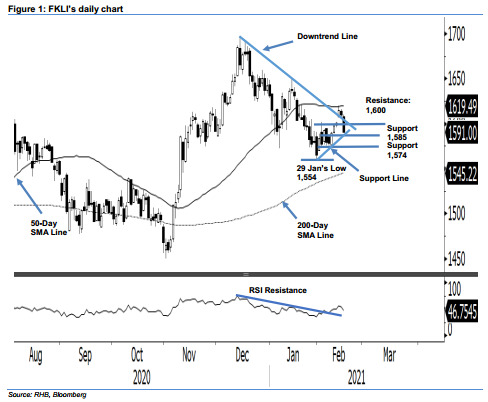

Maintain long positions. The FKLI extended its retracement from the 50-day SMA line, and is falling back below the multi-week downtrend line following the previous session’s “Bearish Harami” formation – highlighting that 15 Feb’s breakout could be a false one. The index shed 18.5 pts to close at 1,591 pts – near the session’s low of 1,590.5 pts. Towards the downside, if the 1,585-pt support is breached (it is close to the 2.5-week counter-trend rebound support line, as depicted in the chart), the FKLI may likely resume the retracement that started from mid-Dec 2020. Until this happens, we maintain a positive trading bias.

We recommend that traders stay in long positions. We initiated these at 1,598 pts – the closing level of 10 Feb. To manage risks, a stop-loss can now be set below 1,585 pts.

The immediate support is revised to 1,585 pts, followed by 1,574 pts. Towards the upside, the immediate resistance is pegged at the 1,600-pt round figure, followed by 1,610 pts.

Source: RHB Securities Research - 18 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024