Hang Seng Index Futures - Blocked by the 31,000-Pt Level

rhboskres

Publish date: Fri, 19 Feb 2021, 05:34 PM

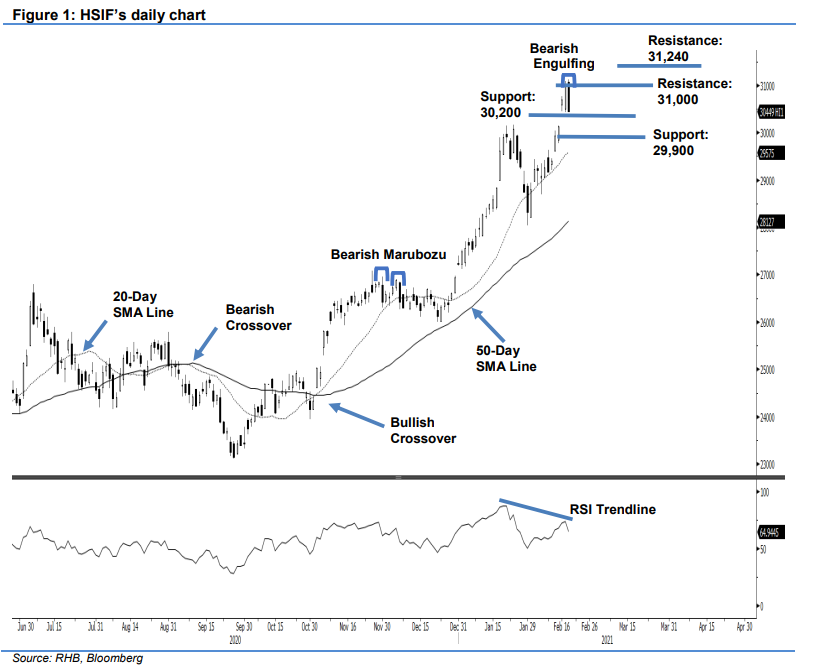

Maintain long positions. The HSIF saw seling pressure near the 31,000-pt level – it declined 526 pts to settle lower at 30,449 pts. The index opened higher yesterday at 31,060 pts. Despite a strong opening, the HSIF was in a jittery state, falling to a 30,431-pt day low and closing at 30,448 pts. During the evening session, the bears continued to trim positions, with the index dropping further towards the session low at 30,170 pts before last trading at 30,316 pts. It was observed that, while the HSIF rallied higher, the momentum indicator RSI recorded a lower high, showing a diverging signal. If the index falls below the 30,200-pt support level, it may see further corrections towards 29,900 pts, or the 20-day SMA line. Since the stop-loss level remains intact, we maintain our positive trading bias.

We recommend traders keep the long positions initiated at 29,230 pts, or the closing level of 2 Feb. To manage risks, the stop loss is placed at 30,200 pts.

The immediate support is revised to 30,200 pts and followed by 29,900 pts. Towards the upside, the immediate resistance is sighted at 31,000 pts, followed by 31,240 pts.

Source: RHB Securities Research - 19 Feb 2021