WTI Crude - Negative Intraday Price Reversal

rhboskres

Publish date: Fri, 19 Feb 2021, 05:53 PM

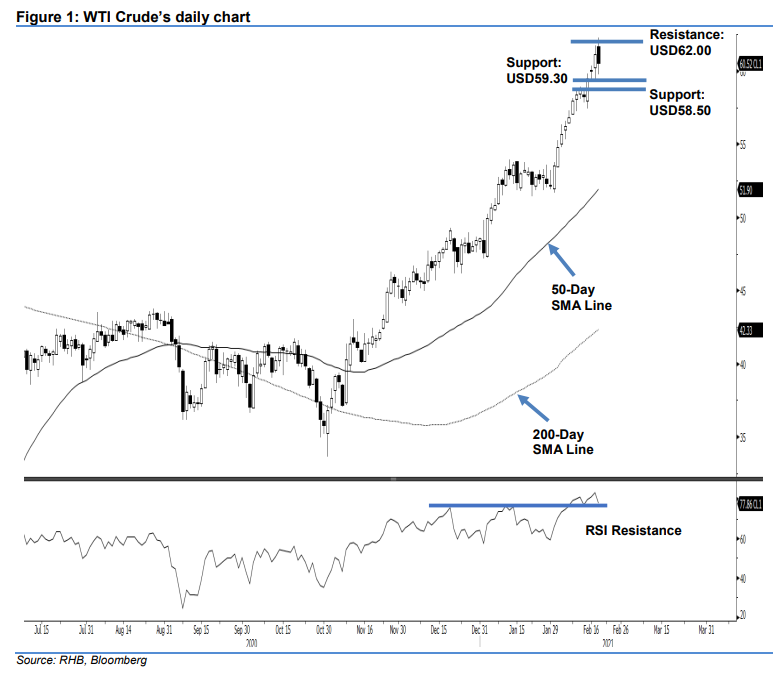

Pending a negative price follow-through, maintain long positions. The WTI Crude’s cold weather-induced spike hit a wall during the latest session. Reversing from its intraday high of USD62.26 – the higest level since Jan 2020 – the commodity reached a low of USD59.79 before closing USD0.62 weaker at USD60.52. Recall that the WTI Crude is trading around the multi-year downtrend line on the back of overbought RSI readings. Should there be a negative follow-through in the coming sessions, ie a close below USD59.00, this will likely signal that the commodity has reached an interim high and a correction phase is developing. Pending this, we are keeping to our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop loss can now be placed below the USD59.00 level.

Support levels are maintained at USD59.30 and USD58.50. Meanwhile, the immediate resistance is set at USD62.00 and followed by USD65.00.

Source: RHB Securities Research - 19 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024