COMEX Gold - Consolidating Sideways

rhboskres

Publish date: Mon, 22 Feb 2021, 09:51 AM

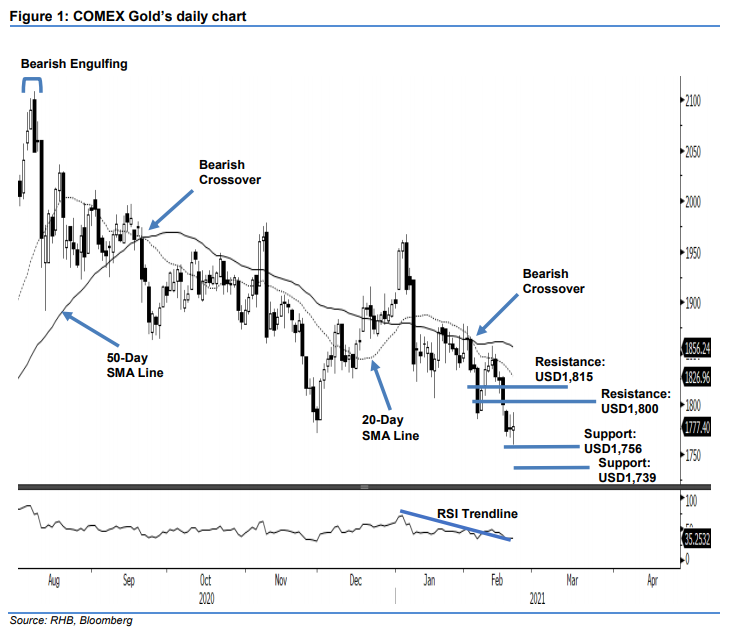

Maintain short positions. The COMEX Gold, supported by mild buying interest, added USD2.40 to settle at USD1,777.40. Last Friday, the commodity opened lower at USD1,774.60, and dipped to the day’s low of USD1,759. From there, it rebounded towards the day’s high of USD1,790.90, before closing at USD1,777.40 – forming a Doji pattern. Based on the latest price actions, the bulls and bears are exhibiting equal strength. As the RSI is hovering below the 50% threshold, showing negative momentum, we think the precious metal needs much consolidation before it can retest the resistance point marked at USD1,800. This, coupled with the 20- and 50-day SMA lines pointing downwards, the COMEX Gold is likely to see downside pressure in the coming sessions. Premised on this, we maintain our negative trading bias.

We recommend traders stick to short positions, initiated at USD1,799 or the closing level of 16 Feb. For risk management purposes, the stop-loss is placed at USD1,815.

The immediate support is unchanged at USD1,756, followed by USD1,739. Towards the upside, the nearest resistance is pegged at the USD1,800 round figure, followed by USD1,815.

Source: RHB Securities Research - 22 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024