Hang Seng Index Futures - The Bulls Are Not Giving Up Yet

rhboskres

Publish date: Mon, 22 Feb 2021, 09:53 AM

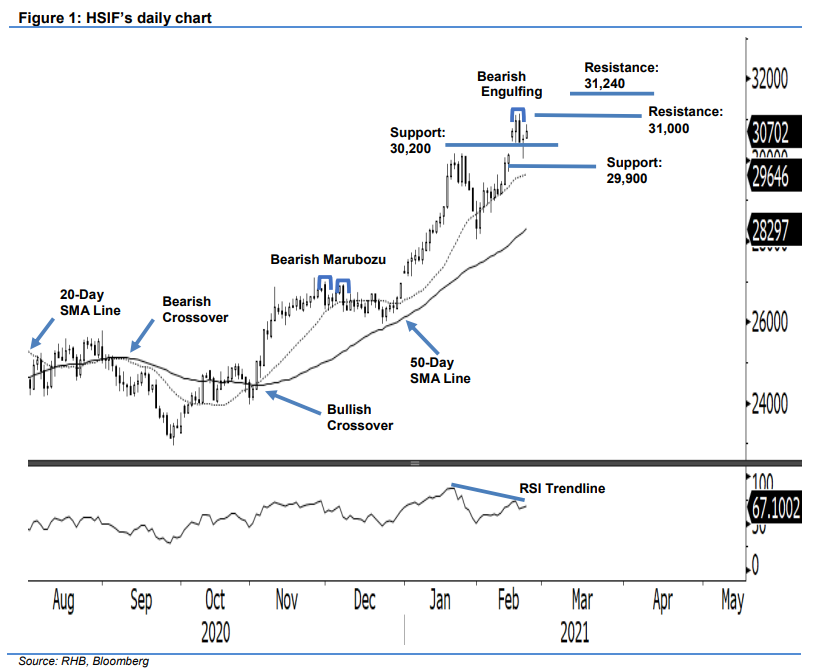

Maintain long positions. The HSIF saw the re-emergence of buying pressure last Friday, recovering 72 pts to settle at 30,521 pts. After Thursday’s bearish session, the index opened slightly higher at 30,388 pts. However, selling pressure emerged during the morning session, dragging the index towards the 30,021-pt day low. In the late afternoon, the index pared its losses, bouncing to the day’s high of 30,620 pts, before closing at 30,521 pts. The evening session saw buying momentum, with the index closing at 30,702 pts after testing the session’s high of 30,858 pts. Based on the latest price actions, the balance of strength leans towards the bulls. Coupled with both the 20- and 50-day SMA lines pointing north, we think the bulls have a grip on the index. Despite the positive price action, the RSI momentum indicator is diverging from the index, signalling the possibility of the index moving into a minor correction phase soon. As long as the stop-loss stays intact, we maintain our positive trading bias.

We recommend traders maintain the long positions initiated at 29,230 pts, or the closing level of 2 Feb. To manage risks, the stop-loss is set at 30,200 pts.

The immediate support is maintained at 30,200 pts, and followed by 29,900 pts. Towards the upside, the immediate resistance is pegged at the 31,000-pt round figure, followed by 31,240 pts.

Source: RHB Securities Research - 22 Feb 2021