WTI Crude - Likely An Incomplete Minor Consolidation

rhboskres

Publish date: Tue, 23 Feb 2021, 09:39 AM

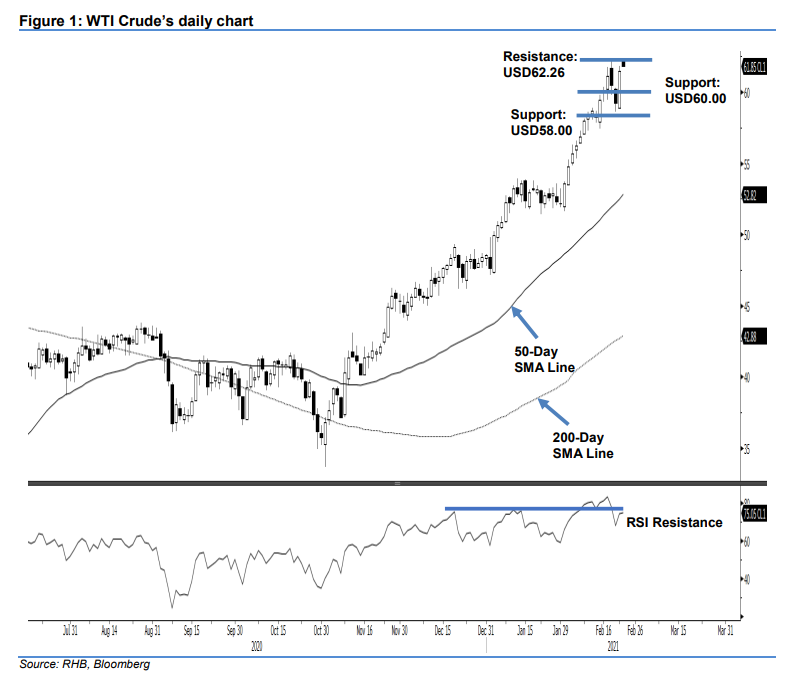

Maintain long positions while adjusting the trailing-stop lower. The WTI Crude rebounded sharply during the latest session following the previous two sessions’ retracements. The intraday tone was positive, as the black gold generally trended up for the whole session after overcoming some selling pressure during the European trading hours. It settled USD2.25 higher at USD61.49 – the high was at USD61.84. Looking at the commodity’s price actions over the past three sessions, we believe it is likely that the minor correction phase has not completed, ie it could still extend into the next 2-3 sessions. We also expect this correction to be realtively narrow in nature, with downside risks limited to the USD58.00 area. We maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop loss is adjusted downwards to below USD58.00.

Support levels are revised to USD60.00 and USD58.00. Meanwhile, the immediate resistance is now pegged at USD62.26 – the high of 18 Feb – and followed by USD65.00.

Source: RHB Securities Research - 23 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024