Hang Seng Index Futures - Testing the Upside Resistance

rhboskres

Publish date: Wed, 24 Feb 2021, 05:31 PM

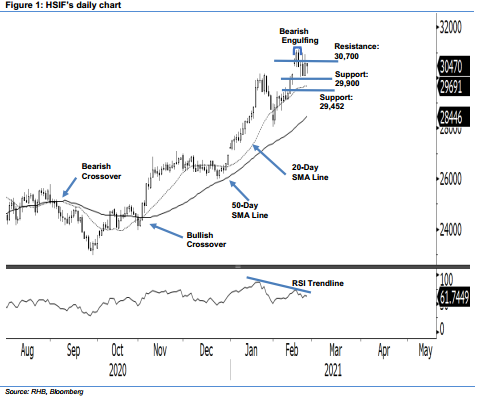

Maintain short positions. After a strong sell-off, the HSIF rose 506 pts to settle at 30,583 pts. The index started the session at 30,150 pts yesterday. Despite the weak opening, it found its footing at the day’s low of 30,936 pts. It was lifted by strong buying pressure, moving towards the 30,936-pt day high, before closing at 30,583 pts. The evening session saw the index consolidate sideways, to close at 30,470 pts, after rebounding from the 30,152-pt session low. Until it crosses the 30,700-pt resistance level, we believe the index is still moving in a correction phase. A breach below the 30-000-pt psychological level will see the index dip towards the 20-day SMA line. Meanwhile, a successful clearance of the upside resistance will see the resumption of the uptrend, whereby the index may rise to negate the Bearish Engulfing reversal pattern. As long as the stop-loss stays intact, we will maintain our negative trading bias.

We recommend traders maintain the short positions initiated at 30,077 pts – the closing level of 22 Feb. For risk management, a stop-loss is set at 30,700 pts.

The immediate support remains at 29,900 pts, followed by 29,452 pts. Towards the upside, the immediate resistance is seen at 30,700 pts, followed by 30,992 pts.

Source: RHB Securities Research - 24 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024