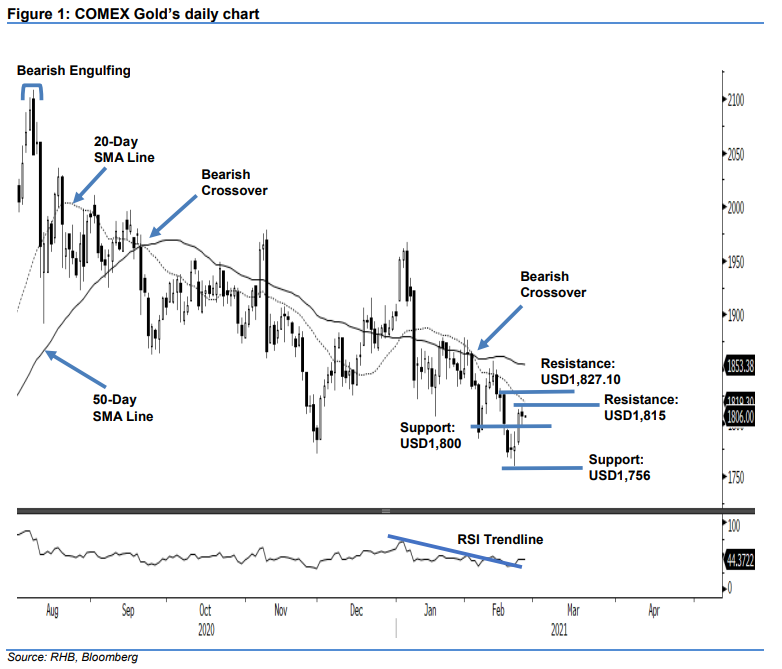

COMEX Gold - Consolidating Below the 20-Day SMA Line

rhboskres

Publish date: Wed, 24 Feb 2021, 05:37 PM

Maintain short positions. The COMEX Gold’s rebound took a breather yesterday, slipping USD2.50 to settle at USD1,805.90. It opened flat at USD1,809.30. During intraday trade, its actions were capped between the day’s high of USD1,815.20 and low of USD1,794.50. At the end of the session, the balance of power indicated that the bulls were slightly stronger than the bears. The 20-day SMA line is seen trending lower, implying resistance or selling pressure on the commodity in the immediate-term. If the precious metal can clear the USD1,815 threshold, we may see a short-term counter trend rebound towards USD1,827.10, or the higher 50-day SMA line hurdle. Meanwhile, a breach below USD1,800 will see the resumption of corrections, and trigger further downside risk. As both moving averages are pointing downwards, we maintain our negative trading bias.

We recommend traders keep to short positions, initiated at USD1,799 or the closing level of 16 Feb. For risk management purposes, the stop-loss is placed at USD1,815.

The immediate support is marked at the USD1,800 round figure, and followed by USD1,756. Towards the upside, the resistance is seen at USD1,815, followed by 16 Feb’s high of USD1,827.10.

Source: RHB Securities Research - 24 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024